For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.1750.

In economic news, data showed that the Euro-zone’s flash consumer confidence index improved to a level of -1.0 in October, notching its highest level since April 2001, indicating that consumers continued to gain confidence as the region’s economic recovery picks up further momentum. Markets had expected the index to advance to a level of -1.1, following a reading of -1.2 in the prior month.

Separately, the Bundesbank’s monthly report indicated that German economic growth will maintain its strong momentum in the third quarter of 2017, driven by robust industrial orders and noted that industrial sector is likely to remain one of the bright spots for the economy. Further, it revealed that construction has probably made no further contribution to growth.

In the US, the Chicago Fed national activity index climbed to a level of 0.17 in September, compared to a revised reading of -0.37 in the previous month, while markets had anticipated for a rise to a level of -0.10.

In the Asian session, at GMT0300, the pair is trading at 1.1762, with the EUR trading 0.1% higher against the USD from yesterday’s close.

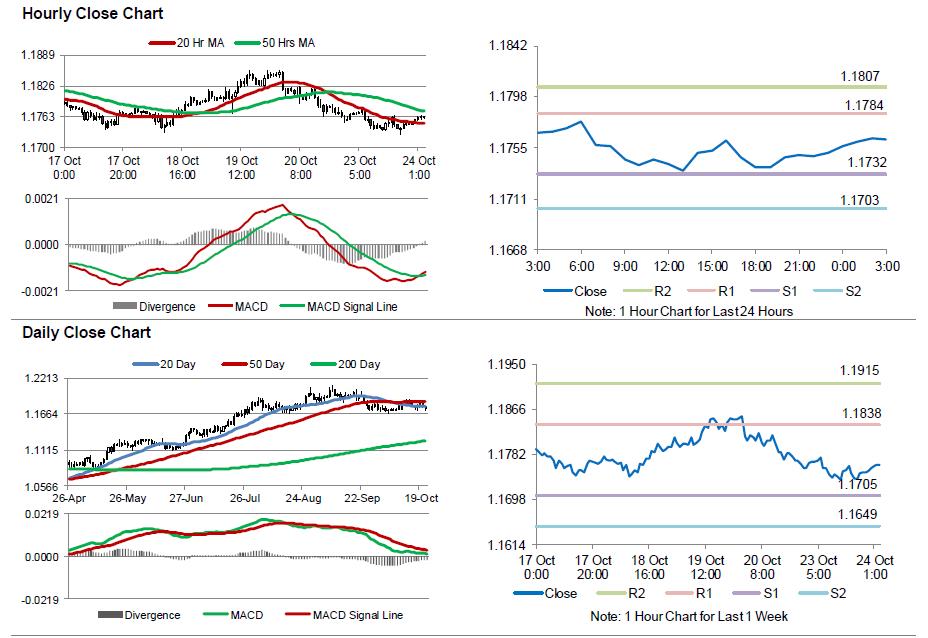

The pair is expected to find support at 1.1732, and a fall through could take it to the next support level of 1.1703. The pair is expected to find its first resistance at 1.1784, and a rise through could take it to the next resistance level of 1.1807.

Trading trend in the Euro today is expected to be determined by the release of preliminary Markit manufacturing and services PMIs for October across the Euro-zone, slated in a few hours. Moreover, the US flash Markit manufacturing and services PMIs, due to release later in the day, will pique significant amount of market attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.