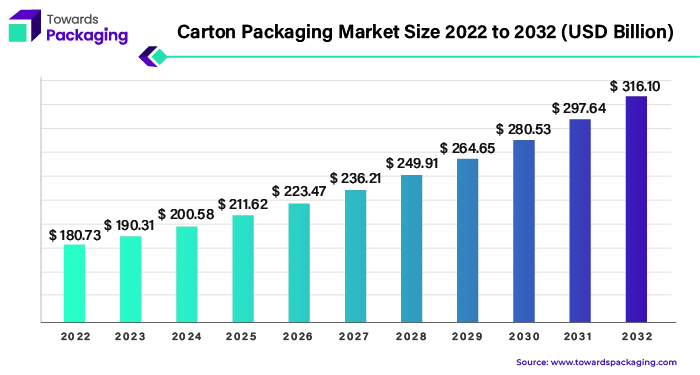

Carton Packaging Market Size to Worth USD 316.10 Bn by 2032

The global carton packaging market size is calculated at USD 200.58 billion in 2024 and is expected to be worth around USD 316.10 billion by 2032, growing at a CAGR of 5.8% from 2024 to 2032.

/EIN News/ -- Ottawa, May 07, 2024 (GLOBE NEWSWIRE) -- The global carton packaging market size was valued at USD 190.31 billion in 2023 and is predicted to hit around USD 297.64 billion by 2031, a study published by Towards Packaging a sister firm of Precedence Research.

Report Highlights: Important Revelations

- Investigating the factors propelling Asia Pacific's dominance in the carton industry.

- Examining the expansion of carton packaging in North America.

- Revolutionizing carton packaging unleashing versatility through paper and paperboard.

- Strength of folding carton packaging ensuring structural stability.

For the short version of this report @ https://www.towardspackaging.com/personalized-scope/5154

The carton packaging sector has significance to many sectors because it provides flexible, sustainable, and cost-effective different packaging options. Carton packing is the use of cardboard or paperboard to make containers, cartons, and other forms of packaging. This market comprises a wide range of items, including corrugated boxes, folding cartons, and liquid packaging cartons, and serves sectors such as food and beverage, pharmaceuticals, cosmetics, and consumer goods.

The growing need for recyclable packaging is a major driver of the carton packaging industry. Cartons are mostly manufactured from renewable materials like paper and cardboard, making them more recyclable and biodegradable than plastic packaging. As environmental concerns increase and consumption of plastic rules increase, businesses are increasingly resorting to carton packaging to fulfil sustainability objectives and consumer preferences.

Carton packaging has exceptional printing potentials, enabling companies to increase product exposure and communicate important data more effectively. With developments in printing technology, producers can create colourful and eye-catching designs that help to increase awareness of the company and customer appeal.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

The food and beverage industry occupies a significant share of the carton packaging market, driven by the demand for safe and convenient packaging solutions. Liquid packaging cartons are frequently used for products such as milk, juice, and other beverages because of their ability to maintain freshness and lengthen shelf life.

The growth of e-commerce has increased demand for carton packing as it's necessary for online sellers to have strong, safe packaging options to guarantee that their products deliver undamaged. due to their strength and ability to withstand handling and transportation, corrugated boxes are extremely prominent in this market.

Innovation, sustainability, and flexibility to shifting marketplace dynamics describe the carton packaging industry. Carton packaging is expected to keep expanding across a range of sectors as long as companies continue to place a high priority on consumer convenience and environmental sustainability.

Customize this study as per your requirement @ https://www.towardspackaging.com/customization/5154

For Instance,

-

In July 2023, the private equity firm Waterland's portfolio company, Carton Group, a prominent player in the packaging sector, has agreed to buy the running operations of Europoligrafico.

Carton Packaging Market Trends

- Lightweighting and decreasing sources are important tactics used in the carton packaging business to maximise material efficiency and decrease packaging waste.

- Carton packaging is increasingly being built with recycling and circularity in mind. Manufacturers are embracing designs that make it simple to recycle and recover materials, such as individual elements and mono-material constructions.

- Digital printing technologies are transforming carton packaging by allowing for high-quality, customisable patterns and shorter manufacturing runs.

- Smart packaging technologies are rapidly being used into carton packaging to improve functionality, interaction, and customer engagement.

Exploring the Driving Forces Behind Asia Pacific's Carton Industry Dominance

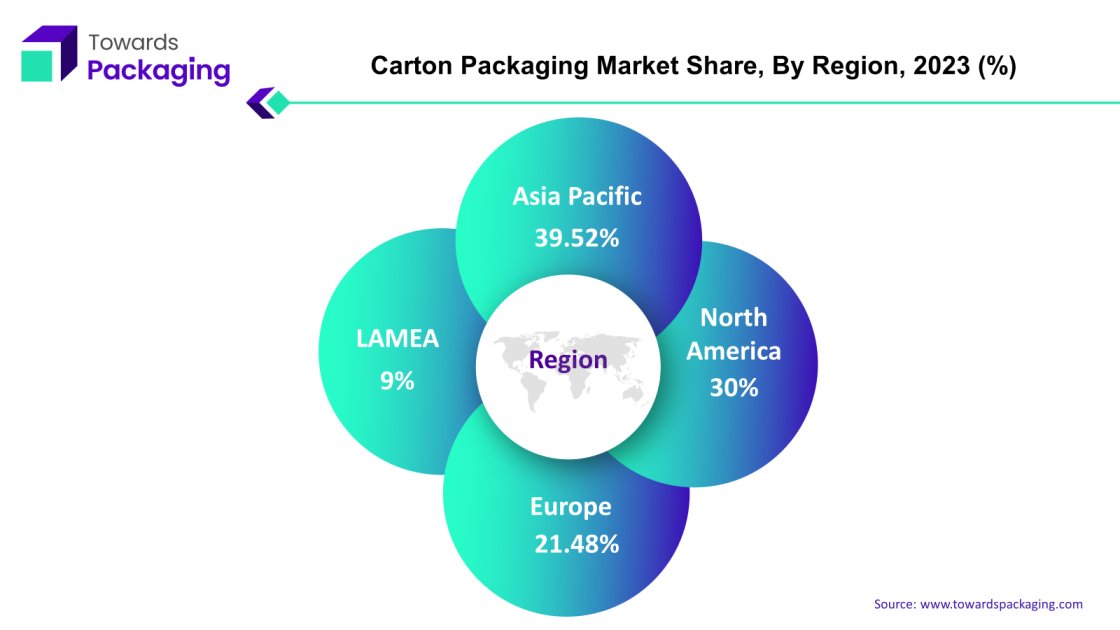

The Asia Pacific region has been leading the carton packaging industry for some years, thanks to a wide range of significant factors. The region's strong economic expansion, specifically in China, India, Japan, and South Korea, has culminated in an increase in consumer demand for packaged products across a wide range of businesses. This growing consumption has inevitably raised the demand for efficient and sustainable packaging solutions, with carton packaging remaining the encouraged choice due to its versatility and sustainability.

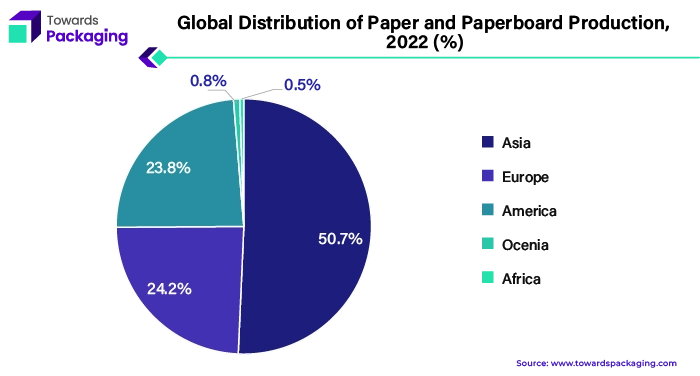

Asia leads regional paper and paperboard manufacturing, with the highest global percentage. The presence of production capability in Asia considerably stimulates the expansion of the carton packaging industry by offering sufficient raw materials for carton manufacture. The region's strong paper and paperboard manufacturing infrastructure enables efficient and cost-effective carton packaging production, which drives market growth. Rapid urbanisation and changing lifestyles in many Asia Pacific regions have culminated in an increase towards convenience-oriented items, increasing demand for packaged goods. Carton packaging, which provides simplicity, portability, and ease of use, has gained widespread acceptance in a range of products, including food and drinks, personal care items, and pharmaceuticals.

The Asia Pacific region has an effective manufacturing infrastructure, with many major carton packaging companies developing factories in strategic locations. This regional production significantly lowers shipping costs, but it also provides companies to adapt their packaging solutions depending on the special demands and preferences of local markets.

Increased awareness of environmental sustainability has ended up in a rise in demand for eco-friendly packaging materials in the Asia Pacific region. Carton packaging, which is recyclable and biodegradable, connects strongly with these environmental goals, encouraging acceptance and market share growth. The Asia Pacific region has emerged as a major force in the carton packaging industry, because of a combination of economic development, shifting consumer tastes, strong manufacturing capabilities, and environmental issues, with its market share frequently increasing.

For Instance,

-

In January 2022, Evergreen Asia, a company that SIG has agreed to buy, will include Pactiv Evergreen's carton packaging and filling machines operations in China, Korea, and Taiwan.

The carton packaging industry is primarily driven by North America, which has seen a major growth in market share due to a variety of causes. Strong consumer demand and the region's economy have provided environment suitable for the development of the packaging market. a combination of its adaptability and eco-friendliness, carton packaging has grown into widely utilised as individuals demand convenience and sustainability steadily increasing. North American carton packaging producers are able to offer creative, tailored solutions that fit the changing demands of multiple industries owing to advancements in printing and packing technology.

The region's growing market share is primarily contributed towards its ability for offering customised packaging solutions. The rise of e-commerce and direct-to-consumer channels has propelled the demand for protective and visually appealing packaging in North America. Carton packaging, particularly corrugated boxes, is well-suited for shipping and handling requirements, further driving its adoption in the region.

The demand for recyclable and biodegradable packaging materials, such as cartons, has increased in North America due to increased awareness of environmental sustainability and government initiatives targeted at decreasing plastic consumption. North America's expanding market share in the carton packaging sector may be attributed to several of factors, including its strategic positioning, technical improvements, growing consumer preferences, and environmental goals.

For Instance,

-

In January 2024, SupplyOne, Inc.—the most significant independent provider of corrugated and other value-added packaging goods, machinery, and services in the US announced the acquisition of Crownhill Packaging, a North American packaging distributor with its main office located in Toronto, Ontario, Canada.

Carton Packaging Market, DRO

Demand:

- Carton packing is valuable because of its capacity to safeguard the enclosed contents. Carton packing protects food, electronics and cosmetics from harm during shipping, handling and storage, preserving their integrity and quality after they reach customers.

Restraint:

- Raw material price fluctuations, particularly for paperboard and pulp, may exert an effect on carton packaging production costs.

Opportunity:

- Innovations in box appearance and function offer significant possibilities for differentiation and value-added offers.

Carton Packaging Reinvented Unlocking Versatility with Paper and Paperboard

Paper and paperboard serve as primary materials for carton packaging because of their versatility, sustainability, and cost-effectiveness. Paperboard, a larger and stronger form of paper, is often used in carton packaging to offer structural support and protection to packaged products. Excellent printability is offered by paper and paperboard, allowing producers to brand and develop attractive designs for carton packaging. This makes them perfect for increasing product visibility and marketing campaigns.

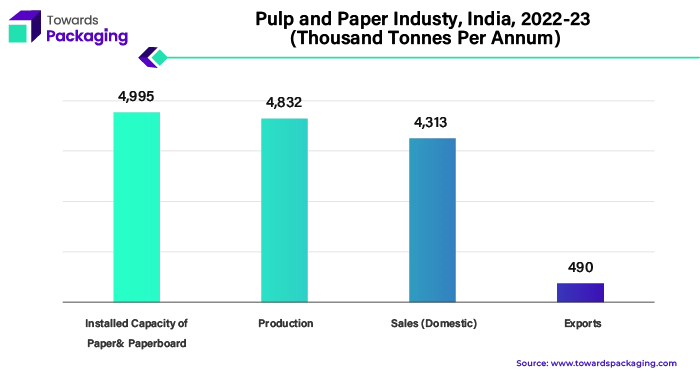

The pulp and paper manufacturing business has a substantial influence on the expanding need for carton packaging throughout Asia Pacific, notably in India. As one of the world's top users of paper and paperboard materials, India's pulp and paper manufacturing business is critical to supplying the region's growing need for carton packaging. Paper and paperboard are renewable and recyclable commodities that meet increasing demands for sustainable packaging solutions. Carton packaging made up of paper and paperboard is readily recyclable and reusable, helping to conserve the environment and reduce the carbon impact.

Paper and paperboard carton packaging can often be adapted to meet specific needs, including size, shape, and strength, making it fitting for a broad range of industries and applications. most of the food and beverages industry, pharmaceuticals and consumer goods, carton packaging consisted of paper and paperboard fulfils a wide range of packaging demands while ensuring product integrity and safety.

Paper and paperboard play an important part in carton packaging, providing a useful, sustainable, and visually appealing solution that fits the needs of modern packaging.

For Instance,

-

In January 2024, Ansa Folding Carton bought a strategic share in Rich Printers Private Limited (RPL) for Rs 117 crore. With the deal, the merged firm has acquired five paper transformation production factories in India, enabling it to become one of the largest pharmaceutical folding carton producers in the nation.

The food and beverages industry has rapidly integrated carton packaging solutions, which has contributed considerably to the carton packaging market's growth. Carton packaging provides several benefits to food and beverage items, including protection, convenience, and sustainability. Cartons provide great protection against external influences such as moisture, light, and air, ensuring that packed items remain fresh and high-quality. This is especially important for perishable foods like dairy products, juices, and ready-made meals. Carton packing is lightweight and easy to handle, making it convenient for both producers and customers to transport, store, and use.

The food and beverage industry's increased emphasis on sustainability complements carton packaging, which is generally constructed of renewable and recyclable materials. Consumers are increasingly looking for eco-friendly packaging solutions, and cartons satisfy this desire by minimising environmental effect and encouraging recycling. With the food and beverage industry being one of the main consumers of packaging materials, its incorporation of carton packaging solutions has contributed significantly to the growth of the carton packaging market. As this tendency continues, carton packaging is projected to be an important part of the food and beverage industry's packaging strategy, accelerating market growth.

For Instance,

-

In April 2022, Tetra Pak and Top Beverage Brands Collaborated to Introduce the First Tethered Caps on Carton Packages in History

Structural Stability Behind Folding Carton Packaging

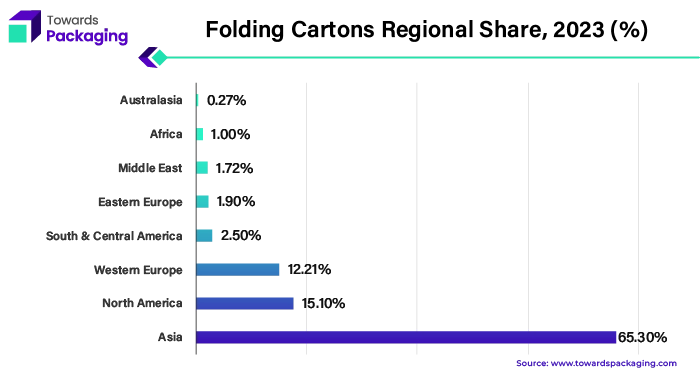

Folding cartons are used as exterior containers for items and are often made of paperboard that resembles thick cardboard. They go through several processes, including printing, laminating, die-cutting, folding, and glueing. These cartons are versatile in design, since they come in a variety of shapes and sizes and may be printed on a variety of substrates. By 2026, the worldwide folding carton packaging industry is expected to be worth more than $160 billion. Paperboard is used as the principal material for folding cartons, giving structural stability. They are typically made of single-ply paperboard with a thickness varying from 14 to 24 points. The size of the carton and the weight of the contents it is designed to carry typically determine the thickness of the paperboard used.

Folding cartons are having a big impact on regional carton packaging market growth because to its versatility, customisation, and cost-effectiveness. Their versatility in design and adequacy for a variety of sectors has resulted in growing global adoption. Folding cartons provide a significant role in the packaging company, offering customised solutions that fulfil an extensive variety of product packaging demands. The flexibility in structure, along with the durability of paperboard, provides the safety and integrity of packed items. As customer preferences change and sustainability becomes an issue, folding cartons remain a popular choice due to their low impact on the environment. The folding carton market's expected development underlines its importance and ongoing relevance in the packaging industry.

For Instance,

-

In February 2023, Mill Rock Packaging Partners LLC, a specialised packaging growth platform and Mill Rock Capital portfolio business, has announced the purchase of Keystone Paper & Box business, a prominent specialty packaging firm that manufactures bespoke folding cartons.

Key Players and Competitive Dynamics in the Carton Packaging Market

The competitive landscape of the carton packaging market is dominated by established industry giants such as American Carton Company, Amcor PLC, Belmark Inc., Bell Incorporated, Chaitanya Packaging Pvt. Ltd., DS Smith PLC, Edelmann GmbH, Essentra PLC, Fortune Industries, Georgia-Pacific LLC by Koch Industries, Inc., Graphic Packaging Holding Company, Huhtamaki Oyj, International Paper, KCL Limited, Mill Rock Capital, MM Packaging GmbH, Mondi PLC, Oji Holdings Corporation, Packman Packaging Private Limited, Pactiv Evergreen Inc., Parksons Packaging Ltd., Rengo Co. Ltd., Seaboard Folding Box Company Inc. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

American Carton Company Focuses on customisation and client-centric solutions, providing custom carton packaging designs to match unique customer requirements. Emphasises quality and dependability in its packaging solutions.

For Instance,

-

In May 2021, Graphic Packaging Holding Company, a major global developer of sustainable fiber-based packaging solutions, has announced its intention to buy Americraft Carton, one of North America's biggest privately held paperboard folding carton manufacturers.

Amcor PLC Implements a diverse approach, providing a wide range of carton packaging solutions to industries like food and beverage, healthcare, and consumer products. To maintain competitiveness, the company invests in innovation and environmental projects.

For Instance,

-

In August 2023, Amcor has announced the acquisition of Phoenix Flexibles, which will boost its capacity in the high-growth Indian sector.

Belmark Inc specialises in high-quality printing and finishing processes for carton packaging, offering visually attractive and luxury packaging options. Focuses on branding and product differentiation through creative packaging design.

For Instance,

-

In January 2024, Kentucky Governor Andy Beshear emphasised the state's manufacturing sector's continued growth as Belmark Inc., a manufacturer of printed pressure sensitive labels, flexible packaging, and folding cartons, opened a new facility in Allen County with a nearly $99 million investment, creating 159 well-paying Kentucky jobs.

Bell Incorporated distinguishes itself by concentrating on environmentally friendly packaging solutions that use sustainable materials and manufacturing techniques. Provides experience in designing and producing recyclable and biodegradable carton packaging choices that fulfil environmental regulations and consumer demands.

For Instance,

-

In August 2023, Graphic Packaging of Atlanta, Georgia, announced the signing of a formal deal to buy Bell Incorporated of Sioux Falls, North Dakota, one of the major folding carton producers in the United States.

Carton Packaging Market Player

Carton packaging leading market players are American Carton Company, Amcor PLC, Belmark Inc., Bell Incorporated, Chaitanya Packaging Pvt. Ltd., DS Smith PLC, Edelmann GmbH, Essentra PLC, Fortune Industries, Georgia-Pacific LLC by Koch Industries, Inc., Graphic Packaging Holding Company, Huhtamaki Oyj, International Paper, KCL Limited, Mill Rock Capital, MM Packaging GmbH, Mondi PLC, Oji Holdings Corporation, Packman Packaging Private Limited, Pactiv Evergreen Inc., Parksons Packaging Ltd., Rengo Co. Ltd., Seaboard Folding Box Company Inc.

Browse More Insights of Towards Packaging:

- The global connected packaging market size predicted to climb from USD 42.89 billion in 2022 to hit a presumed USD 74.30 billion by 2032, escalating at a 5.7% CAGR between 2023 and 2032.

- The global bulk container packaging market size is estimated to grow from USD 3.70 billion in 2022 to reach an estimated USD 9.31 billion by 2032, growing at a 9.7% CAGR between 2023 and 2032.

- The global contract packaging market size is speculated to escalate from USD 76.84 billion in 2022 to reach a conjectured USD 168.22 billion by 2032, broadening at a 8.2% CAGR between 2023 and 2032.

- The global returnable glass bottle market size calculated to go up from USD 5.24 billion in 2022 to accomplish a supposed USD 9.35 billion by 2032, enlarging at a 6% CAGR between 2023 and 2032.

- The global pharmaceutical contract packaging market size forecasted to expand from USD 14.21 billion in 2022 to achieve an approximation USD 36.11 billion by 2032, escalating at a 9.8% CAGR between 2023 and 2032.

- The global polyethylene films market size forecasted to expand from USD 90.19 billion in 2022 to accomplish a supposed USD 139.98 billion by 2032, increasing at 4.5% CAGR between 2023 and 2032.

- The global coffee bags market size speculated to escalate from USD 591.70 million in 2022 to realize an expected USD 1,015.47 million by 2032, multiplying at 5.6% CAGR between 2023 and 2032.

- The global pharmaceutical glass packaging market size envisaged to surge from USD 18.12 billion in 2022 to acquire an anticipated USD 41.92 billion by 2032, advancing at 8.8% CAGR between 2023 and 2032.

- The global confectionery packaging market size envisioned to advance from USD 10.34 billion in 2022 to secure an forecasted USD 14.65 billion by 2032, flourishing at a 3.6% CAGR between 2023 and 2032.

- The global pharmaceutical packaging equipment market size is estimated to climb from USD 7.76 billion in 2022 to calculate USD 15.92 billion by 2032, thriving at a 7.5% CAGR between 2023 and 2032.

Market Segments

By Material

- Paper & Paperboard

- Plastic

- Biopolymers

By Product Types

- Folding Cartons

- Rigid Cartons

- Liquid Cartons

By End User

- Food and Beverage

- Healthcare & Pharmaceutical

- Personal care & Cosmetics

- Household

- Industrial

- Others

By Region

- Asia Pacific

- North America

- Europe

- LAMEA

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5154

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.