Closing Bell: ASX up again as iron ore miners rally; Qantas to pay $120m for ‘ghost flights’ fiasco

News

News

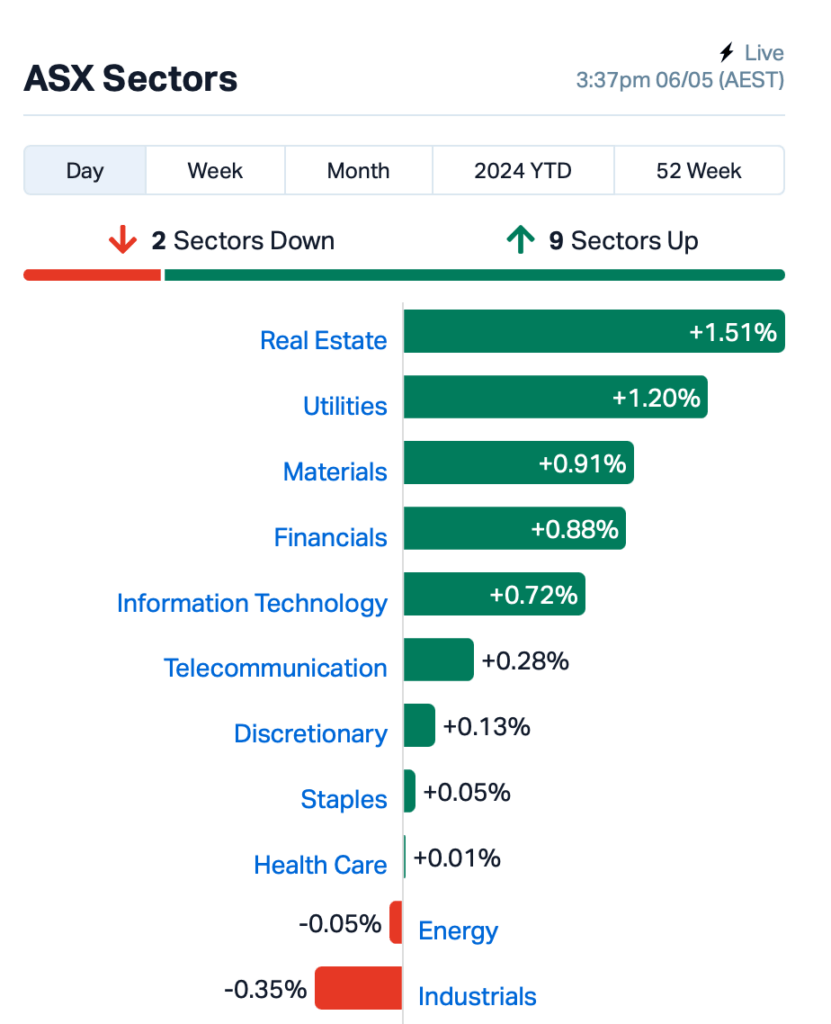

The Aussie stock market extended gains on Monday, up +0.6% on the back of the weaker than expected job numbers in the US last Friday.

Wall Street rallied after US non-farm payrolls rose by 175k jobs in April, versus the 240k consensus in the Bloomberg survey – boosting expectations of a September Fed rate cut.

“…The market is fully discounting a 25bp September interest rate cut once again, with a second one before the end of the year,” said ING’s Chief Economist, James Knightley.

Interest rate-sensitive tech and real estate stocks boosted the ASX today.

Qantas (ASX:QAN) was up slightly despite getting caught with its wings down in the “ghost flights” fiasco, admitting it tricked passengers into boarding flights that were straight-up non existent. Qantas will pay $100 million to the penalty jar, and a sweet $20 million for the people who got ghosted.

Bank stocks got a boost after Westpac (ASX:WBC) rose 3% despite its first-half profit taking a nosedive, down 16%. What got investors excited was Westpac’s announcement that it will be handing out some cash to shareholders, with a special dividend of 15 cents per share and an interim dividend of 75 cents per share. The bank even bumped up its buyback program from $1.5 billion to $2.5 billion.

Iron ore miners meanwhile were riding high, tracking a higher iron ore price in Singapore. Fortescue Metals (ASX:FMG) added 2% and BHP (ASX:BHP) rose 0.9%,

Chinese shares led the pack in Asia today, with traders swooping in after a holiday break. But stocks in Hong Kong were taking a breather after a nine-day winning streak.

China’s President Xi Jinping arrived in France, ready to smooth things over with Europe, particularly on the trade front.

Former RBA Governor Phil Lowe meanwhile has painted a pretty gloomy picture, saying that Aussie rates might actually go up rather than down, thanks to inflation. In an interview with the Australian Financial Review, Lowe said getting back to 2.5% inflation is not yet guaranteed.

The RBA board are currently huddling for their first of a two-day meeting today, with a rates decision due tomorrow.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RR1 | Reach Resources Ltd | 0.020 | 122% | 8,134,459 | $6,642,975 |

| 1TT | Thrive Tribe Tech | 0.014 | 75% | 2,427,840 | $3,012,972 |

| MRD | Mount Ridley Mines | 0.002 | 50% | 2,500,000 | $7,784,883 |

| ANX | Anax Metals Ltd | 0.037 | 42% | 23,548,206 | $15,374,245 |

| ICG | Inca Minerals Ltd | 0.007 | 40% | 2,660,992 | $4,023,694 |

| IXU | Ixup Limited | 0.015 | 36% | 7,307,117 | $16,548,612 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 954,000 | $9,296,169 |

| XPN | Xpon Technologies | 0.017 | 31% | 907,590 | $4,336,906 |

| AEV | Avenira Limited | 0.007 | 27% | 5,419,636 | $12,919,687 |

| CHW | Chilwaminerals | 0.600 | 26% | 148,059 | $21,790,625 |

| BFC | Beston Global Ltd | 0.005 | 25% | 4,452,226 | $7,988,188 |

| ME1 | Melodiol Glb Health | 0.003 | 25% | 4,742,804 | $1,346,974 |

| MKL | Mighty Kingdom Ltd | 0.005 | 25% | 5,807,163 | $9,990,399 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 311,327 | $4,027,548 |

| HRZ | Horizon | 0.041 | 21% | 1,442,505 | $23,833,445 |

| ATH | Alterity Therap Ltd | 0.006 | 20% | 1,573,966 | $26,225,577 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 276,667 | $6,425,957 |

| CAV | Carnavale Resources | 0.006 | 20% | 9,892,988 | $17,117,759 |

| IVX | Invion Ltd | 0.006 | 20% | 1,811,324 | $32,122,661 |

| LRL | Labyrinth Resources | 0.006 | 20% | 149,423 | $5,937,719 |

| 5EA | 5Eadvanced | 0.215 | 19% | 490,805 | $60,041,851 |

| SXE | Sth Crs Elect Engnr | 1.460 | 19% | 2,952,255 | $322,438,368 |

| AQD | Ausquest Limited | 0.013 | 18% | 1,628,614 | $9,076,641 |

| TG6 | Tgmetalslimited | 0.300 | 18% | 724,549 | $13,791,973 |

| MTM | MTM Critical Metals | 0.068 | 17% | 10,018,018 | $16,304,197 |

Gold minnow Prodigy Gold (ASX:PRX) enjoyed a bump on Monday after announcing an update from its 100% owned Hyperion deposit in the Tanami region of the Northern Territory. The company said that metallurgical testwork on material from the Hyperion deposit “reinforces potential for excellent gold recoveries through a conventional Carbon In Leach (CIL) plant”.

“A significant reduction in sodium cyanide consumption compared to the initial testwork did not negatively impact the overall 48-hour gold recovery, with recovery levels remaining between 96.8% and 98.0% at a P80 150μm grind size for the oxide, transitional and fresh sample material,” Prodigy said, adding that it did need to add just a touch of lime to the process to really get things cooking.

Security-focused tech company IXUP (ASX:IXU) was moving up on news that “discussions regarding the secure cloud deployment of the IXUP platform in a project involving several of the country’s largest companies, and government / educational organisations have now progressed to the commercial negotiation phase”. The company has been developing its platform to allow for the secure sharing and analysis of sensitive information using advanced encryption technology, so the move to a commercial negotiation phase is a big step forward in bringing the tech to market.

Mineral exploration and development company Mantle Minerals (ASX:MTL) rose on on news that its gold exploration drilling program is about to commence on the recently granted tenements at Mt Berghaus. This is quite newsworthy as the Mt Berghaus tenement covers an 84km2 patch of ground immediately north of De Grey’s monstrous Hemi discovery. Mantle has 122 aircore drillholes planned, which the company says “will be drilled to refusal”, which sounds needlessly aggressive but I’m told that just how the mining industry does things.

Lumos Diagnostics (ASX:LDX) has completed the first phase of its Development Agreement to develop a new foetal fibronectin (fFN) test for leading women’s health company, Hologic, Inc. (NASDAQ: HOLX). Lumos has completed the first of three phases, meaning that it is now due to receive $0.4 million, with half of it recognised in Q3 FY24 and the rest in Q4 FY24. Lumos’ agreement with Hologic aims to improve Hologic’s existing product for pre-term birth diagnosis, making it even better and more user-friendly.

IDT Australia (ASX: IDT) meanwhile has just received a grant from the Victoria State Government to help set up Australia’s first manufacturing facility for Antibody-Drug-Conjugates (ADCs), which are a special type of cancer treatment. This grant, from the Victorian Industry Investment Fund, will support IDT’s new $3.8 million facility in Boronia, Victoria.

Gold, copper, nickel, uranium, lithium play TechGen Metals (ASX:TG1) made the announcement of some new exploration opportunities it’s pursuing as it aims to expand its portfolio further into copper-nickel-uranium territories in WA. The new operations are: Copper Springs (Cu); Springvale (Cu-Ni-PGE); and two uranium projects dubbed Ponton and Myroodah.

Rimfire Pacific Mining (ASX:RIM) was enthused today about its recent 100-hole air core drilling program that’s successfully defined thick zones of strong scandium anomalism from surface, across multiple locations at the Murga scandium prospect, which is on Rimfire’s Fifield project, about 70km northwest of Parkes, NSW. It’s talking thick, strong zones of the stuff, defined from surface across multiple locations throughout the 20km2 Murga intrusive, including: 22m at 232ppm Sc, with 12m at 305ppm Sc; 22m at 156ppm Sc from 2m, with 4m at 220ppm Sc, and more.

Mandrake Resources (ASX:MAN) was up on news that Rio Tinto-backed Direct Lithium Extraction (DLE) and refining company ElectraLith have successfully produced 99.9% pure battery-grade Lithium Hydroxide from Mandrake’s 100%-owned Utah Lithium Project using its cutting-edge DLE-R process. Mandrake and ElectraLith are currently progressing a Strategic Partnership Agreement to facilitate the construction of a DLE-R pilot facility at the Utah Lithium Project.

Finder Energy (ASX:FDR) announced that it has received offer letters from the North Sea Transition Authority (NSTA), notifying that it has been successful in winning two licences in the final tranche of awards in the 33rd UK Offshore Licensing Round. The first licence is located in the Ettrick Sub-basin between Finder’s P2528 and P2527 licences, and is adjacent to the giant Buzzard and Golden Eagle oil fields. The second licence is located to the north on the South Halibut Shelf, where Finder will hold a 100% interest.

Pioneer Credit (ASX:PNC) advised that it is upgrading its FY24 Purchase Debt Portfolio (PDP) investment guidance from $85m to circa $95m. This represents a ~12% increase on prior investment guidance, and marks the company’s second investment upgrade in FY24. At the outset of FY24, the company forecast PDP investment of $60m.

And MTM Critical Metals (ASX:MTM)’s Flash Joule Heating (FJH) prototype testing has produced significant increases in the acid leachability of Rare Earth Elements (REE) and target Critical Metals from Coal Fly Ash (CFA) samples. CFA samples treated by the FJH prototype have delivered a +50% increase in the recovery of REE and Critical Metals.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RR1 | Reach Resources Ltd | 0.020 | 122% | 8,134,459 | $6,642,975 |

| 1TT | Thrive Tribe Tech | 0.014 | 75% | 2,427,840 | $3,012,972 |

| MRD | Mount Ridley Mines | 0.002 | 50% | 2,500,000 | $7,784,883 |

| ANX | Anax Metals Ltd | 0.037 | 42% | 23,548,206 | $15,374,245 |

| ICG | Inca Minerals Ltd | 0.007 | 40% | 2,660,992 | $4,023,694 |

| IXU | Ixup Limited | 0.015 | 36% | 7,307,117 | $16,548,612 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 954,000 | $9,296,169 |

| XPN | Xpon Technologies | 0.017 | 31% | 907,590 | $4,336,906 |

| AEV | Avenira Limited | 0.007 | 27% | 5,419,636 | $12,919,687 |

| CHW | Chilwaminerals | 0.600 | 26% | 148,059 | $21,790,625 |

| BFC | Beston Global Ltd | 0.005 | 25% | 4,452,226 | $7,988,188 |

| ME1 | Melodiol Glb Health | 0.003 | 25% | 4,742,804 | $1,346,974 |

| MKL | Mighty Kingdom Ltd | 0.005 | 25% | 5,807,163 | $9,990,399 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 311,327 | $4,027,548 |

| HRZ | Horizon | 0.041 | 21% | 1,442,505 | $23,833,445 |

| ATH | Alterity Therap Ltd | 0.006 | 20% | 1,573,966 | $26,225,577 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 276,667 | $6,425,957 |

| CAV | Carnavale Resources | 0.006 | 20% | 9,892,988 | $17,117,759 |

| IVX | Invion Ltd | 0.006 | 20% | 1,811,324 | $32,122,661 |

| LRL | Labyrinth Resources | 0.006 | 20% | 149,423 | $5,937,719 |

| 5EA | 5Eadvanced | 0.215 | 19% | 490,805 | $60,041,851 |

| SXE | Sth Crs Elect Engnr | 1.460 | 19% | 2,952,255 | $322,438,368 |

| AQD | Ausquest Limited | 0.013 | 18% | 1,628,614 | $9,076,641 |

| TG6 | Tgmetalslimited | 0.300 | 18% | 724,549 | $13,791,973 |

| MTM | MTM Critical Metals | 0.068 | 17% | 10,018,018 | $16,304,197 |

Bailador Technology Investments (ASX:BTI) has increased the value of its investment in Rosterfy by 27% to $2.7m to reflect its strong operating performance over the past 12 months.

Brightstar Resources (ASX:BTR) has raked in $6.5m in profit from mining its Selkirk joint venture and will use the funds for a 30,000m reverse circulation and diamond drilling program across its Menzies and Laverton in WA’s Goldfields region.

Hot Chili (ASX:HCH) has raised $24.9m through a private placement and is seeking another $5m to accelerate development of its Costa Fuego copper-gold project in Chile by funding the PFS, further drilling along with setting up a new water company.

Mt Malcolm Mines (ASX:M2M) has proved that its Golden Crown prospect is amendable to conventional cyanide extraction methods with preliminary metallurgical testing achieving average gold recoveries of 94.3%.

Neurotech International (ASX:NTI) has reported further primary and secondary endpoint analysis of its Phase 1/2 trial NTIRTT1 showing significant additional benefits in Rett Syndrome girls after 12 weeks of daily oral treatment with its broad-spectrum cannabinoid drug therapy NTI164.

Gravity survey at St George Mining’s (ASX:SGQ) Destiny project has defined new high-priority targets with the potential to host niobium, REE or nickel-copper-PGE mineralisation.

Sunshine Metals’ (ASX:SHN) recently completed induced polarisation surveys have identified seven new targets with gold and base metal anomalism at its Ravenswood Consolidated project near the historical Highway-Reward mine in Queensland’s Charter Towers district.

Uvre (ASX:UVA) has entered into a binding agreement to acquire 100% of the issued capital in Uranium SA, a special purpose vehicle with three uranium prospects across two exploration licences in South Australia’s Frome basin.

Queensland Pacific Metals (ASX:QPM) has received a cash refund of $16.1m from the Australian Tax Office comprising $15.8m under the Research Development Tax Incentive Scheme and associated interest. The refund is related to eligible research and development activities the company carried out in FY2023 on expenditure related to the TECH nickel project in Queensland.

Proceeds have been used to repay a short-term loan of $12.6m the company had taken out against the tax refund.

Western Yilgarn (ASX:WYX) has executed a contract for an airborne electromagnetic survey of 1800 line kilometres covering 350km2 of ground over its Ida Holmes Junction project in Western Australia. The Phase 1 survey will be run concurrently with the ongoing auger geochemistry campaign with results from both playing a key role in planning for the maiden aircore/reverse circulation drill program. Ida Holmes Junction is ~50km southwest of Gold Fields’ Agnew Gold project and is highly prospective for copper, nickel and platinum group elements as well as lithium-caesium-tantalum pegmatites.

Anson Resources (ASX:ASN) has appointed current chief operating officer (COO) Tim Murray as director, effective immediately. Murray was instrumental in securing the binding offtake term sheet with LG Energy Solution and will continue to pursue offtake agreements to fulfill the initial planned production capacity of 10,000tpa for ASN’s Paradox Basin project. ASN executive chairman and CEO Bruce Richardson says since his appointment as COO in January 2023, Murray has made a significant contribution to the company, not only on the LG agreement, but in many aspects of its growth. “Tim’s appointment strengthens the board’s commercial skill base, particularly in relation to doing business in Asia, which is required at this stage of the company’s development.”

Iltani Resources (ASX:ILT) has begun the next phase of drilling at the Orient silver-indium project in Northern Queensland. The explorer plans to drill 11 reverse circulation holes for 2,300m as it works its way towards establishing an exploration target at the Orient West prospect. Results will form the basis for subsequent resource estimate drilling with the program estimated to take between three to four weeks to complete. “We’re marking the start of what we believe will be an exciting period of drilling at Orient where we plan to extend the known mineralisation by over a 1,800m strike length,” ILT managing director Donald Garner says.

Caprice Resources (ASX:CRS) – ending an announcement regarding an acquisition and a capital raising.

Firebird Metals (ASX:FRB) – pending release of an announcement in relation to the results of the Company’s Battery Grade Manganese Sulphate Feasibility Study.

Hartshead Resources (ASX:HHR) – pending an announcement in relation to the 33rd Offshore Licensing Round Tranche 3 Awards.

At Stockhead, we tell it like it is. While Queensland Pacific Metals, Western Yilgarn, Anson Resources, Iltani Resources, Bailador Technology Investments, Brightstar Resources, Hot Chili, Mt Malcolm Mines, Neurotech International, St George Mining, Sunshine Metals and Uvre are Stockhead advertisers, they did not sponsor this article.