Mapped: House and rental prices revealed across the UK as growth accelerates

Figures from the Office of National Statistics show average private rent in the UK was £1,326 per month in February 2025

House prices across Britain have accelerated but rental prices have slowed down, official figures show.

New figures from the Office of National Statistics (ONS) showed the annual rate of house price growth has reached 4.9 per cent in the year to January 2025 – up from 4.6 per cent in the 12 months to December 2024.

Meanwhile, the average monthly rent across the UK increased by 8.1 per cent in the 12 months to February 2025, according to the ONS.

This was slower than the 8.7 per cent increase recorded in the 12 months to January 2025.

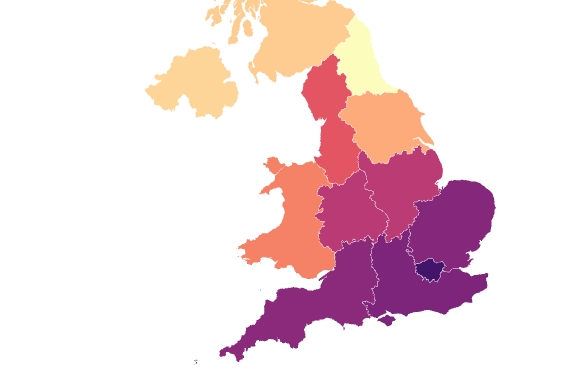

Average house prices increased to £291,000 (4.8 per cent annual growth) in England, £210,000 (6.0 per cent) in Wales, and £187,000 (4.6 per cent) in Scotland, in the 12 months to January 2025.

Average private rent in the UK was £1,326 per month in February 2025, which was £99 higher than a year earlier.

The maps below show the average house prices and monthly rent in local areas across the country:

Within England, the North East had the highest house price inflation in the 12 months to January 2025, at 9.1 per cent, while London had the weakest growth at 2.3 per cent.

There was a widespread fall in average house price across Wales between December 2023 and January 2024, with 15 of the 22 local authorities in Wales experiencing a monthly fall in average price, the ONS said.

Stamp duty discounts are set to become less generous from April, with “nil rate” bands becoming smaller. Stamp duty applies in England and Northern Ireland.

The average rent for England was £1,381 in February 2025, up 8.3 per cent (£105) from a year earlier. In Wales, the average rent was £785 in February 2025, up 8.5 per cent (£62) from a year earlier.

Richard Donnell, executive director at Zoopla said: “Rents are still rising faster than earnings and we expect rental inflation to slow further over 2025.

“House prices are rising on the back of increased activity over 2024 with 10% more sales and lower mortgage rates boosting demand, along with a rush to beat the stamp duty holiday.

“Our latest Zoopla data shows a significant increase in the supply of homes coming onto the market, rising at a faster pace than sales. Together with weaker first-time buyer demand and higher buying costs for most purchases, after April we will see price growth slowing over 2025.”

The figures were released as a separate ONS report showed that Consumer Prices Index (CPI) inflation eased by more than expected.

The rate of CPI inflation slowed to 2.8 per cent in February, from 3 per cent in January, following expectations from analysts that CPI inflation would be slightly higher.

David Hollingworth, associate director at L&C Mortgages said the slowing in inflation “can have positive implications for mortgage rates if it helps to boost the market’s outlook for interest rate movements”.

He added: “Today’s news may not do enough to materially shift the forecasting though and although this should undoubtedly be seen as good news, it’s widely anticipated that the rate of inflation will lift again in coming months.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments