🎙️ Voice is AI-generated. Inconsistencies may occur.

President Trump signaled Monday that he has no intention of backing down from his sweeping tariff plans, despite speculation that rising market volatility might prompt a pause. Speaking from the Oval Office, Trump dismissed the idea outright, even as he claimed multiple countries were eager to negotiate new trade agreements with the U.S.

What to Know:

- Trump said he is "not looking" at pausing tariffs.

- He emphasized that "many, many countries" want to strike trade deals.

- The president insisted talks and tariffs aren't mutually exclusive, adding, "They can both be true."

- The remarks come amid growing concerns that the trade war could lead to global economic slowdown.

This live blog is now closed.

Trump slams EU trade policies, vows to cut $350B deficit

Trump on Monday repeated his long-standing criticism of the European Union's trade practices, calling them unfair and one-sided.

"It's got to be fair and reciprocal. It's not fair," Trump said, pointing to limited U.S. car sales in Europe as an example. He claimed the U.S. trade deficit with the EU, roughly $350 billion, would "disappear fast" if Europe began purchasing more American energy.

"They're going to have to buy it from us. We can knock off $350 billion in one week," he said.

Netanyahu promises to eliminate trade deficit with U.S.

Israeli Prime Minister Benjamin Netanyahu said Monday that Israel will eliminate its trade deficit with the United States and swiftly remove its tariffs. Speaking alongside Trump after their Oval Office meeting, Netanyahu emphasized the importance of balanced trade.

"Free trade has to be fair trade," Netanyahu said, pledging that Israel would act "quickly" to drop its tariffs. In response, Trump said, "That's very nice, thank you."

The remarks come amid heightened global trade tensions following new tariffs imposed by the Trump administration.

Trump 'not looking at' a pause in tariffs

Trump said today that he is "not looking at" a pause in tariffs.

Economic blackout tour: Which stores face boycott after Walmart

An emerging grassroots campaign group is stepping up its plan for economic "blackouts" and boycotts against American retailers, with a rolling series of direct-action protests planned well into the summer. The group is currently calling on shoppers to boycott Walmart this week.

Future events will focus on hitting the profits being made by Walmart, General Mills, Amazon, Target, and McDonalds.

Walmart told Newsweek, in part, "Serving communities is at the heart of Walmart's purpose to help people save money and live better." Newsweek has also contacted the other four companies by email seeking comment.

The movement was initiated as a response to corporate rollbacks of diversity, equity and inclusion (DEI) programs—notably at companies like Target—and also in protest against President Trump's plans to cut the government workforce, NPR reported.

The events are being run by a group called People's Union USA, and founder John Schwarz has previously told Newsweek that the organization's "mission" is designed to force "corporations to start paying their fair share of taxes so the American people can finally be relieved of the burden of federal income tax." Schwarz has also cited a number of other factors behind the movement, including a drive for equality, opposition to rising prices, and an attempt to help smaller local businesses.

The group emphasized broader goals: "economic resistance, government accountability, and corporate reform." Founder John Schwarz said the campaign is not about Elon Musk or Trump, but about "the system as a whole." The group advocates eliminating federal income tax, capping corporate profits, and "promoting equality for all."

Wall Street nears bear market territory as tariff fears mount

Wall Street is edging closer to a bear market as growing concerns over President Trump's sweeping tariffs shake investor confidence. Analysts warn that added taxes on imported goods could severely impact global economic growth.

A bear market is defined by a sustained drop of 20% or more from recent highs. The S&P 500 was down 1.2% on Monday afternoon and is now 18.4% below its February peak. The Dow Jones Industrial Average slipped 1.8%, while the Nasdaq, already in bear territory, dropped another 0.9%.

Some analysts say the current downturn resembles the rapid 2020 bear market more than the slower decline of 2022.

U.S. trade representative to testify on global response to new tariffs

U.S. Trade Representative Jamieson Greer is set to testify before the Senate Finance Committee on Tuesday, revealing that nearly 50 countries have reached out to discuss the new tariffs imposed by President Donald Trump. In written testimony obtained by Reuters, Greer noted that countries like Argentina, Vietnam, and Israel have expressed intentions to reduce their tariffs and non-tariff barriers.

Greer acknowledged that the U.S. trade deficit, which has persisted for over three decades, won't be solved immediately, but emphasized that these steps are a positive move towards addressing the issue.

OPINION: China's ready for a trade war. The U.S. isn't. Here's why

President Donald Trump has announced tariffs reaching up to 54 percent on Chinese imports, continuing his trade war with China from his first time in office. But this time, the stakes are different, and Beijing's response has caught Washington off guard.

Instead of triggering panic in Beijing, Trump's announcement has been met with strategic calculation. Chinese officials didn't mirror the tariff escalation in kind. They went for precision. China strategically targeted $15 billion in U.S. agricultural exports, delivering a precise blow to Republican strongholds during peak planting season. The timing compounds the economic anxieties of already struggling farmers.

In this war of attrition, Beijing isn't just retaliating, it's evolving. Since the first iteration of Trump's trade war in 2018, China has restructured its import portfolio, welcoming Brazil and Russia. American agricultural products once made up 40 percent of China's market; that amount has fallen below 20 percent. Brazil and Russia are now supplying China's growing demand with fewer political strings attached.

Read the full opinion piece by Geostrategic Analyst Imran Khalid on Newsweek.

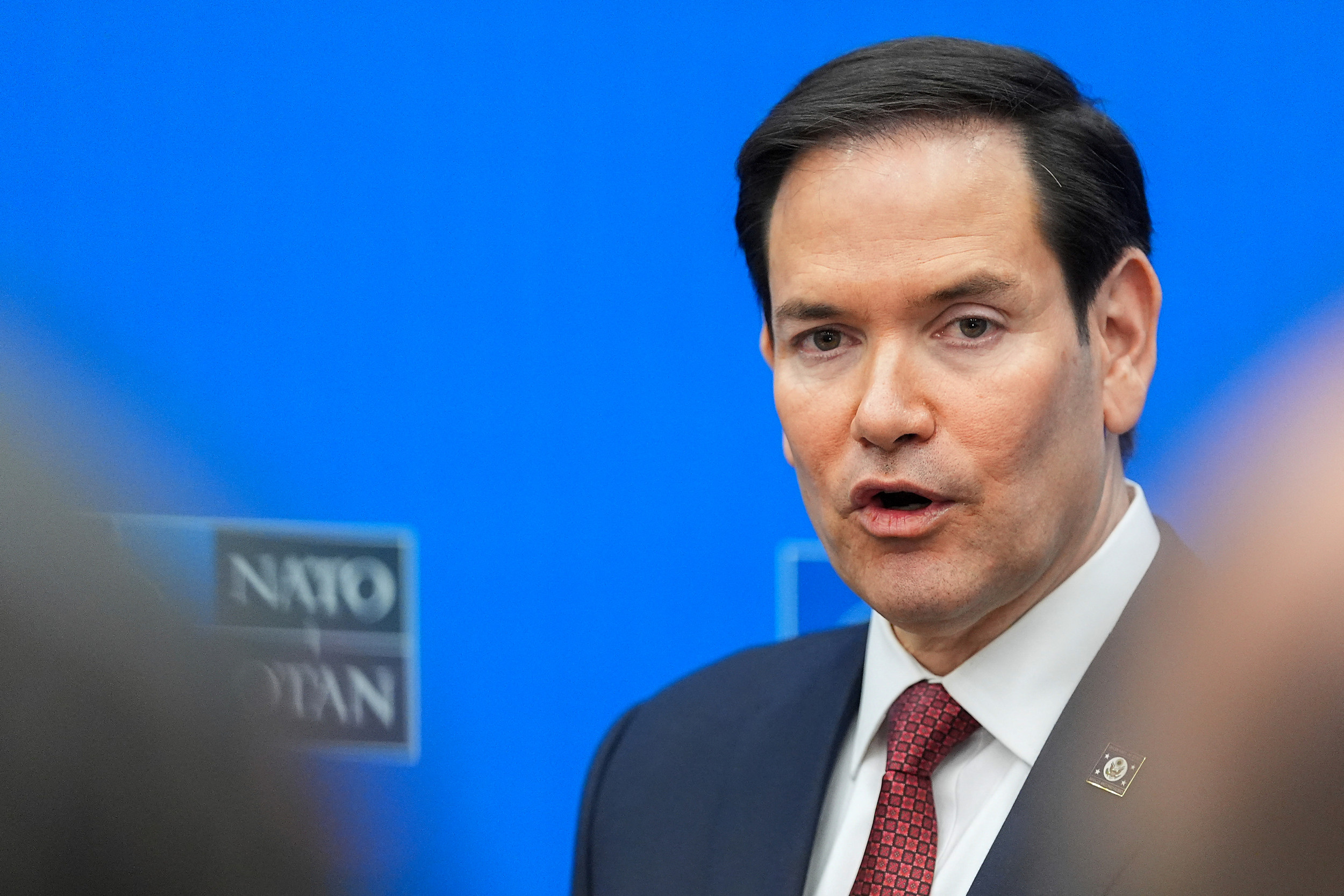

U.S. secretary of state Marco Rubio speaks with Pakistan's Ishaq Dar after tariffs imposed

U.S. Secretary of State Marco Rubio spoke with Pakistan's Deputy Prime Minister Ishaq Dar following Trump's decision to impose a 29% tariff on exports from Pakistan. The conversation, which took place on Monday, focused on bilateral relations, regional security, and economic cooperation.

In a statement released by Pakistan's Ministry of Foreign Affairs, Rubio emphasized that future relations between the U.S. and Pakistan would be centered around economic and trade cooperation. This dialogue comes amid significant economic tension, with Pakistan's stock market experiencing a sharp decline following the tariff announcement.

European Commission proposes counter-tariffs on U.S. goods in response to Trump's steel and aluminum tariffs

The European Commission unveiled a proposal on Monday for 25% counter-tariffs on a variety of U.S. goods, a direct response to Trump's tariffs on steel and aluminum.

According to a document seen by Reuters, the tariffs will be implemented in two phases: some goods will be affected starting May 16, while others will face tariffs beginning December 1.

Notably, bourbon, which had initially been considered for inclusion in the March proposal, has been removed from the final list.

Beijing uses Reagan's words to criticize Trump's tariffs

Beijing has sharply criticized Trump's tariffs, citing a 1987 speech by the late President Ronald Reagan as a warning about the dangers of escalating trade wars. The Chinese Embassy in the U.S. shared a video clip of Reagan's remarks on social media, highlighting his warning that high tariffs lead to retaliation, increased trade barriers, and economic harm.

In the video, Reagan, a Republican, stated, "High tariffs inevitably lead to retaliation by foreign countries and the triggering of fierce trade wars." He went on to describe the devastating consequences of such wars: collapsing markets, business shutdowns, and widespread job losses. The embassy added that Reagan's decades-old words "find new relevance in 2025," signaling China's concerns over the continued imposition of tariffs under Trump's administration.

Trump administration revokes visas for international students at US universities

The Trump administration has initiated a new wave of visa revocations targeting international students studying at American universities. Universities across the nation, including Harvard University, the University of Michigan, Stanford University, and UCLA, reported that several students had their visas revoked. It remains unclear if these actions are linked to anti-Israel sentiments or political activities on campuses.

At Harvard University, the Department of Homeland Security (DHS) revoked the visas of three graduate students and two recent graduates. Similar incidents occurred at other universities, where visa revocations were discovered during routine record reviews, with many institutions not being directly informed by DHS.

The University of Michigan also saw four students affected by the visa cancellations, with one student already leaving the country. Secretary of State Marco Rubio commented on the situation, stating that visas are being revoked daily due to concerns over students' involvement in activist movements. Rubio emphasized the administration's stance on denying visas to students participating in such activities.

This development follows ongoing concerns about political movements on US campuses, with the Trump administration taking a cautious approach to student visas, particularly for those linked to organized protests or activism.

US set to more than double duties on Canadian softwood lumber

The U.S. is preparing to more than double duties on Canadian softwood lumber, raising tariffs to 34.45%, which will further pressure materials costs in the US housing market, Bloomberg reports. Currently, duties stand at 14.4%, but a memo from the Department of Commerce reveals a proposed increase of 20 percentage points, which would significantly affect lumber imports.

This comes before Trump potentially imposes additional tariffs on the sector. Trump has ordered a national security investigation into US lumber imports, claiming the U.S. does not need Canadian wood, though US homebuilders argue that more tariffs would only raise housing costs for Americans.

The dispute stems from the long-standing trade conflict between the US and Canada. The U.S claims Canadian sawmills benefit from subsidies due to low "stumpage" fee.s set by provincial governments. Canada, however, maintains that its stumpage system is market-driven, with timber sold through competitive auctions.

Lumber is a key industry in Canadian provinces like British Columbia and Quebec, where officials and industry leaders are voicing concerns that the new tariffs will harm local workers and increase housing costs for U.S consumers. In Quebec, companies are struggling to navigate both rising produ.ction costs and the looming trade barriers.

Trump's new China tariffs could more than double import costs

Donald Trump's Monday post on Truth Social signaling a 50% tariff hike on Chinese imports could push the total cost of many goods well over double their original price, as layers of tariffs stack up.

Trump initially imposed a 10% tariff, followed by another 10% linked to fentanyl concerns. Last week, he announced a 34% increase. The latest move appears to tack on an additional 50%.

That's on top of first-term tariffs of up to 25% that President Joe Biden later expanded—raising rates on Chinese electric vehicles to 100% and boosting tariffs on semiconductors and solar products to 50%.

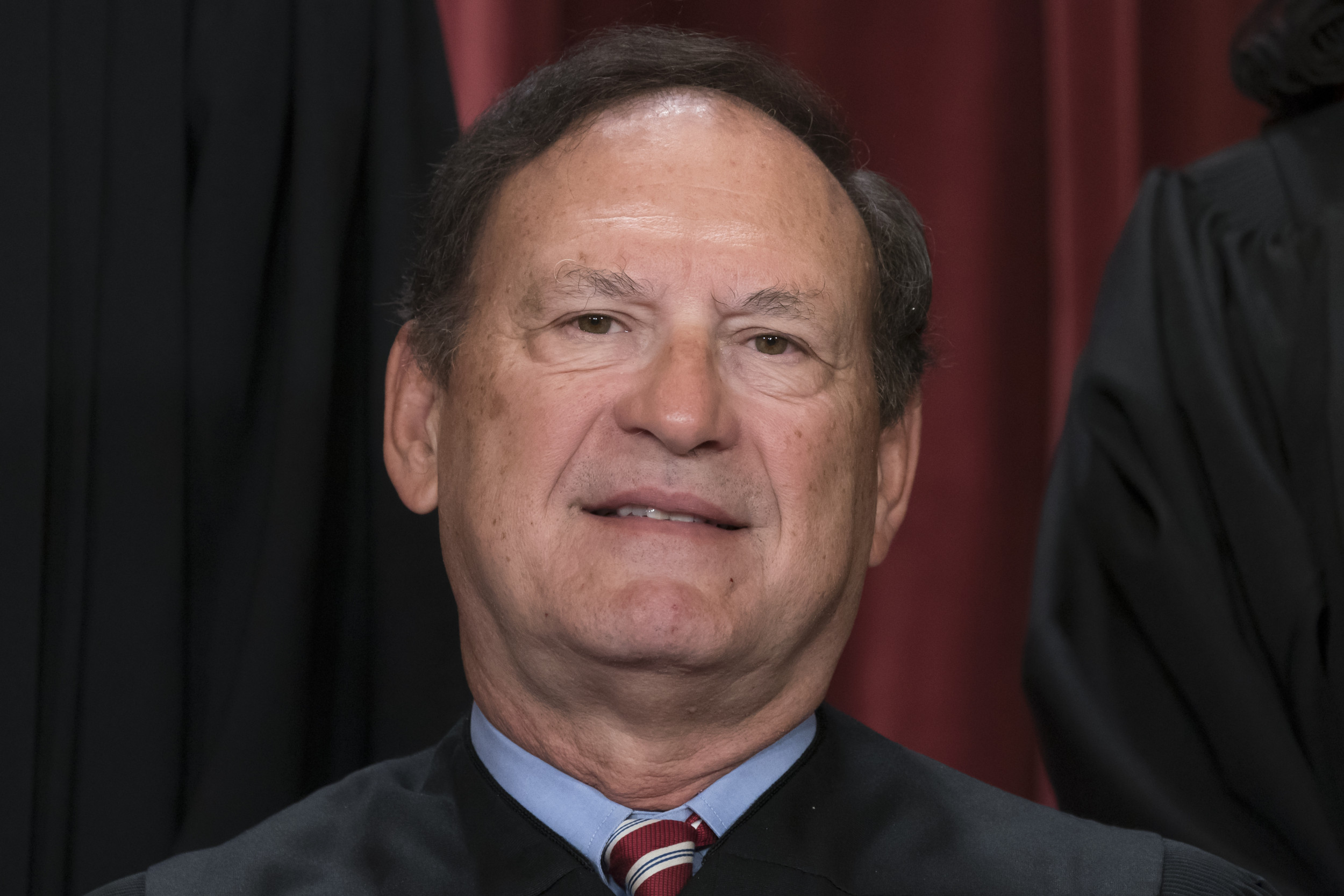

Trump asks Supreme Court to halt order to return deported Maryland man

The Trump administration on Monday urged the Supreme Court to block a federal judge's order requiring the return of a Maryland man who was deported to a notorious prison in El Salvador. In an emergency appeal, the Justice Department argued that U.S. District Judge Paula Xinis exceeded her authority when she directed the government to bring Kilmar Abrego Garcia back to the United States.

Although the administration acknowledged that Abrego Garcia should not have been deported—citing an immigration judge's finding that he likely faced persecution by local gangs—it claimed he is no longer in U.S. custody and cannot be retrieved. Judge Xinis had given the government until just before midnight Tuesday to "facilitate and effectuate" his return.

NerdWallet's Sam Taube offers investing tips amid market volatility

As tariff battles and economic uncertainty continue to rattle markets, NerdWallet investing spokesperson Sam Taube is sharing practical advice for investors looking to stay focused and resilient.

Taube told Newsweek that bear markets, though uncomfortable, are normal and often shorter than bull markets. Staying calm and avoiding panic selling can help investors benefit when markets rebound.

He also stresses the importance of maintaining a long-term perspective. "Knee-jerk reactions to short-term drops can lock in losses," he notes, while a steady focus on long-term goals allows for recovery and growth.

Diversification remains crucial, especially during downturns. Taube points to recession-resistant sectors like healthcare and the use of bond ladders as ways to build stability. International stocks can also help offset domestic risk.

Lastly, he encourages dollar-cost averaging—investing steadily over time—to help smooth out volatility and avoid the pitfalls of trying to time the market.

Trump threatens new tariffs on China, escalating trade fight

Trump warned Monday that the U.S. will impose new 50% tariffs on China if it does not roll back its latest round of retaliatory measures. The warning, delivered in a Truth Social post, followed Beijing's announcement of a 34% tariff hike on U.S. goods.

Trump accused China of "long term trading abuses" and said any country that retaliates against existing U.S. tariffs will face even higher penalties. He said the new tariffs would take effect April 9 if China does not reverse course by April 8.

He also threatened to end trade talks with Chinese officials and said negotiations with other countries would begin instead. The statement revived fears of a renewed global trade war and sent shockwaves through markets already rattled by rising protectionism.

Trump administration ends critical humanitarian programs across the Middle East

The Trump administration has informed the World Food Program (WFP) and other partners that it is terminating some of the last remaining lifesaving humanitarian initiatives in the Middle East. A U.S. official and a U.N. official confirmed to The Associated Press that around 60 contracts were canceled in the past week, affecting major projects in Lebanon, Jordan, Syria, and other regions like Yemen, Somalia, Afghanistan, and Zimbabwe.

The terminations, directed by Jeremy Lewin from the Department of Government Efficiency, are part of ongoing efforts to dismantle the U.S. Agency for International Development (USAID). The cuts impact vital programs that provide food, medical care, water, and shelter to displaced individuals, contradicting previous administration promises to protect these crucial services. This decision is part of a broader push to reduce perceived wastefulness within USAID and other foreign assistance efforts. There has been no immediate response from the State Department regarding these terminations.

Richard Branson calls for swift reversal of U.S. tariffs in series of tweets

Richard Branson shared his thoughts on leadership and the economic consequences of U.S. tariffs in a series of tweets on April 4.

The Virgin Group founder emphasized the importance of strong leadership, which includes taking risks but also quickly admitting mistakes and correcting them. Branson argued that the sweeping tariffs imposed by the U.S. government are heading the global economy in a dangerous direction, warning that they will negatively impact people worldwide.

(1/4) Strong leadership means taking risks and trying things - but when it doesn’t work, realising your mistake and correcting it. Quickly.

— Richard Branson (@richardbranson) April 4, 2025

Cryptocurrencies join global market sell-off

Cryptocurrencies, which had remained relatively stable during last week's market turmoil, have now followed the broader market in a sell-off. Bitcoin, the leading cryptocurrency, dipped below $75,000 on Monday morning before showing a slight recovery. This marks the lowest price for Bitcoin since just after the 2020 U.S. presidential election when its value surged.

Bitcoin's supporters often refer to it as "digital gold," positioning it as a potential hedge against market volatility. However, cryptocurrency analyst Garrick Hileman pointed out that Bitcoin's price drop undermines that theory, as it continues to behave more like a volatile tech stock than a stable asset. Other major digital currencies, such as ether, XRP, and solana, experienced even larger declines during the same period.

This latest downturn has raised concerns about the true resilience of cryptocurrencies during financial instability.

'Black Monday' fears grow for stock market: What to know

Concerns are rising about a "Black Monday" market crash over President Donald Trump's tariff hikes and the resulting backlash from China.

Major stock indexes plunged in Asia on Monday after Wall Street experienced the worst two days since the pandemic last week, the S&P 500 down 6 percent by market close on Friday while the Dow Jones Industrial Average plunged 5.5 percent. The Nasdaq composite dropped 5.82 percent.

CNBC host and market analyst Jim Cramer on Saturday warned of a repeat of the devastating "Black Monday" collapse of October 19, 1987, when the Dow Jones Industrial Average saw its worse single-day fall and plummeted 22.6 percent.

Wall Street rebounds after news of potential tariff pause

U.S. stock markets reversed earlier losses and rose sharply after White House economic adviser Kevin Hassett revealed that President Trump might consider a 90-day suspension of tariffs on all countries except China.

As of 10:20 a.m. ET, the Dow Jones Industrial Average was up by 333.50 points (0.87%), reaching 38,614.49. The S&P 500 gained 79.99 points (1.69%), reaching 5,154.07, and the Nasdaq Composite climbed by 362.69 points (2.33%) to 15,950.47. Investors showed optimism, reacting favorably to the possibility of a pause in trade tensions.

Japanese PM expresses concerns over U.S. tariffs' impact on investment

Japanese Prime Minister Shigeru Ishiba voiced strong concerns over U.S. tariffs during a telephone call with President Donald Trump on Monday. Ishiba expressed fears that the tariffs could discourage investment from Japan, which has been the top foreign investor in the U.S. for the past five years.

Ishiba urged Trump to pursue a more mutually beneficial trade relationship and assured that Japan would continue to negotiate for a reconsideration of the measures. The two leaders agreed to form a team of representatives to handle further discussions.

Ishiba also called the situation a "national crisis" and said Japan would hold a ministerial task force meeting to address the issue. He emphasized the need for a counterproposal to reshape U.S.-Japan relations, although he ruled out retaliatory measures, believing they would only escalate the situation. The Japanese government, he added, would support industries affected by the tariffs, particularly small and medium-sized businesses.

Navarro dismisses Vietnam's tariff offer as insignificant

White House trade adviser Peter Navarro has dismissed Vietnam's recent offer to reduce its tariffs on American exports to 0%, calling it "meaningless." The offer came after a "productive" call between Trump and Vietnam's General Secretary Tô Lâm. However, Navarro stressed that the focus should not be on tariffs alone, but on "non-tariff cheating" by foreign nations.

The U.S. is set to impose high "reciprocal" tariffs on several countries, including Vietnam, starting April 9. With a proposed 46% tariff rate, Vietnam, which was the sixth-largest source of U.S. imports last year, faces significant impact. The new tariffs could raise the cost of goods like electronics, apparel, and footwear that the U.S. imports heavily from the country.

Navarro calls for removal of foreign trade barriers, targets EU restrictions

White House trade counselor Peter Navarro doubled down on the U.S.'s stance on foreign trade, insisting that countries remove the "non-tariff barriers" hindering American commerce. Navarro said these barriers, stating they "suck our blood" and demand removal.

He specifically called on the European Union to ease its value-added taxes and restrictions on American meat, which is produced with hormones or other chemicals.

Navarro accused foreign countries of "stealing from the American people" and emphasized that simply lowering tariffs wouldn't suffice.

Navarro announces upcoming tax cuts and benefits, responds to Musk

Peter Navarro, White House trade counselor, spoke on CNBC Monday, revealing plans for soon-to-be-implemented tax cuts and additional benefits for American citizens, which include deregulation, lower energy prices, reduced interest rates, and a reshaping of the country's manufacturing sector. He said that these actions would help return manufacturing to the U.S. while boosting real wages and profits, predicting the market would eventually stabilize.

Navarro also addressed recent criticisms from Elon Musk, who had voiced concerns over tariffs and Navarro's role in their implementation. Navarro countered by saying that Musk, who had questioned the tariffs, is "not a car manufacturer but a car assembler," noting that Tesla's Texas plant relies on imported parts such as batteries and electronics.

Wall Street opens sharply lower

Wall Street's main indexes opened sharply lower on Monday, with the S&P 500 on track to enter bear market territory. As of 9:31 a.m., the Dow had fallen 1,212.98 points, or 3.17%, to 37,101.88.

The S&P 500 lost 181.37 points, or 3.57%, dropping to 4,892.71, while the Nasdaq saw a steeper decline of 623.23 points, or 4.00%, settling at 14,964.56. The broad sell-off reflects growing concerns over the economy and the potential for further market instability.

S&P 500 drops 3%, heading toward bear market

The S&P 500 opened the trading day down more than 3%, signaling a potential entry into bear market territory.

If the losses continue, the index would be 20% or more below its recent peak, a key indicator of a bear market.

Goldman Sachs warns of lasting economic impact from tariff announcement

Goldman Sachs has raised concerns about the long-term economic damage caused by recent tariff announcements, suggesting that a recession is increasingly likely, even if Trump alters his trade policies. The firm lowered its growth forecast, citing factors like tightened financial conditions, foreign consumer boycotts, and rising policy uncertainty that could severely limit capital spending.

Goldman Sachs further noted that meeting prior economic expectations would now require a significant reduction in the tariffs set to take effect on April 9, warning that the economic outlook could worsen without this change.

Trump asks the country to not be 'weak' or 'stupid'

Trump shared another post on Truth Social this morning, urging people to not be "weak" or "stupid," calling them "panicans," which he says is a "new party based on Weak and Stupid people."

Mike Johnson strikes deal after MAGA infighting

House Speaker Mike Johnson has struck a deal with Florida Representative Anna Paulina Luna over their standoff regarding proxy voting for new parents.

In a Sunday post on X, formerly Twitter, Luna said the pair reached an agreement to formalize a centuries-old procedure called "live/dead pairing," which allows lawmakers to symbolically vote by proxy, with the vote canceled out by an opposing one.

Newsweek has contacted Johnson's office for comment via email.

Proxy voting is largely opposed by MAGA and hard-line Republicans, including Johnson. The compromise with Luna could increase pressure on Johnson from MAGA figures, as he already faces a potential challenge to remain House speaker in the GOP's narrow majority in the lower chamber.

Wall Street braces for more losses as tariffs spark economic fears

Wall Street is set to begin the week with more substantial losses as worries grow that the U.S. tariffs imposed by Trump may result in a global economic slowdown.

Shares in both European and Asian markets experienced sharp declines, while U.S. futures also fell. The S&P 500 futures dropped 2.7% in premarket trading, with the index now down 17.4% from its February high. A drop of 20% or more from a recent peak would signify a bear market.

Oil prices saw another significant drop, briefly falling below $60 a barrel for the first time since 2021.

Futures for the Dow Jones Industrial Average and Nasdaq also declined, down 2.4% and 3%, respectively, reflecting widespread investor concerns about the impact of ongoing trade tensions.

Federal appeals court rules against Trump's attempt to remove board members

A federal appeals court in Washington, D.C. has ruled to reinstate members of the National Labor Relations Board (NLRB) and the Merit Systems Protection Board (MSPB) whom Trump had sought to remove, Politico reporter Kyle Cheney shared via X.

The court's decision was a 7-4 split, citing laws that protect these members from dismissal without cause.

The ruling could pave the way for the Supreme Court to take up the case, though further details are still to come.

Netanyahu to meet Trump as first foreign leader after tariffs

Israeli Prime Minister Benjamin Netanyahu will meet U.S. President Donald Trump in Washington on Monday, becoming the first foreign leader to visit since Trump imposed sweeping tariffs on multiple countries.

While Netanyahu's visit focuses on the new tariffs, it will also cover major geopolitical issues, including the war in Gaza, tensions with Iran, and Israel's relationship with Turkey. The outcome of the meeting could influence how other world leaders approach the U.S. tariffs.

Netanyahu's office has indicated that discussions will center on the 17% tariff Israel faces, although it remains unclear if any resolution will be reached. In preparation for the visit, Israel announced last week that it would remove all tariffs on U.S. goods, including food and agricultural imports.

Experts expect Trump to use the tariff issue as leverage, potentially pressing Netanyahu for concessions, including a pause in the Gaza conflict.

Germany sees spike in exports to U.S. ahead of Trump tariffs

Germany reported a significant rise in exports to the United States in February, marking an 8.5% increase compared to the previous month, reaching 14.2 billion euros ($15.6 billion). This surge came just ahead of U.S. President Donald Trump's announcement of sweeping tariffs, as Germany solidified its position as Europe's top economy and a leading exporter.

The U.S. became Germany's biggest trading partner last year, surpassing China for the first time in nearly a decade. Overall, German exports worldwide rose 1.8% in February to 131.6 billion euros.

However, Dirk Jandura, head of Germany's exporters association BGA, cautioned that the increase was likely due to anticipatory effects, as U.S. firms stockpiled goods and German companies expedited shipments ahead of the tariffs.

Jandura also emphasized the need for Germany and the EU to quickly adapt to the changing global trade landscape and explore new opportunities with emerging markets. He suggested that Europe's response to the U.S. tariffs could position it as a reliable global partner.

Hong Kong vows stability despite market plunge

Hong Kong Financial Secretary Paul Chan said Monday that recent market volatility does not require drastic action, even after the city's stock market fell 13.2% in a single day.

Chan said the market remains orderly, with strong trading activity on both sides, but warned that U.S. tariffs and global interest rate shifts will likely fuel more instability.

He criticized the U.S. tariffs as "bullying and unreasonable," accusing them of harming global supply chains and slowing economic recovery.

Chan also reaffirmed Hong Kong's status as a free port with distinct policies from mainland China.

EU eyes energy and defense talks after U.S. tariff hike

A Latvian official said Monday the European Union may seek negotiations with the U.S. on energy security and military trade in response to a new 20% tariff on EU exports.

Artjom Uršulskis, parliamentary secretary at Latvia's foreign ministry, said finding common ground is more productive than escalating tensions.

"Trade wars are never favorable for everyone," he told reporters ahead of an EU trade ministers meeting.

Uršulskis also pushed back on suggestions the EU should target U.S. services, saying the bloc should avoid "new wars and new battlefields."

Dimon warns of economic turbulence in annual letter

JPMorgan Chase CEO Jamie Dimon said the U.S. economy is "facing considerable turbulence," citing tariffs, inflation concerns, and high market valuations.

In his annual letter to shareholders, Dimon cautioned that recent tariffs could fuel inflation and increase the risk of a recession. Despite recent market declines, he said stock prices remain elevated.

"Markets still seem to be pricing assets with the assumption that we will continue to have a fairly soft landing," he wrote. "I am not so sure."

China issues sharp rebuke to Trump's tariffs

China has issued a sharp rebuke of new U.S. tariffs, accusing Washington of "unilateralism, protectionism and economic bullying" in a growing trade confrontation that has drawn in major companies such as Tesla and GE Healthcare.

Putting "America First" over international rules harms the stability of global production and the supply chain and seriously impacts the world's economic recovery, China's Foreign Affairs spokesperson Lin Jian told reporters.

Chinese officials criticized the administration of President Donald Trump after it imposed a sweeping 34 percent tariff on Chinese goods, escalating from previous rounds of tariffs announced earlier this year.

Beijing has responded with its own 34 percent tariff on American exports and has moved to restrict key imports such as sorghum and poultry while tightening export controls on critical rare earth elements. At the same time, China filed a formal complaint with the World Trade Organization, signaling the dispute could extend into international legal channels.

fairness meter

To read how Newsweek uses AI as a newsroom tool, Click here.