Seeking A Volatility Shield? 2 Stocks Worth A Look

Image Source: Pixabay

It’s been a volatile couple of weeks in the market, with tariff talks spooking investors and causing negative price action in many of the leading stocks.

But investors can help balance out their risk profiles by targeting low-beta stocks, helping during intense volatility spikes like we’ve recently witnessed.

Several low-beta stocks, namely The Progressive Corp. (PGR - Free Report) and American Water Works (AWK - Free Report), could be seen as ‘defensive’ additions.

In addition, both currently sport favorable Zacks Ranks, reflecting positive EPS revisions among analysts. Let’s take a closer look at each.

PGR Keeps Impressing

PGR shares have been rockstar performers in 2025 so far, up more than 20% and widely outperforming relative to the S&P 500. Strong quarterly results helped aid the move, with its next set expected in the coming weeks.

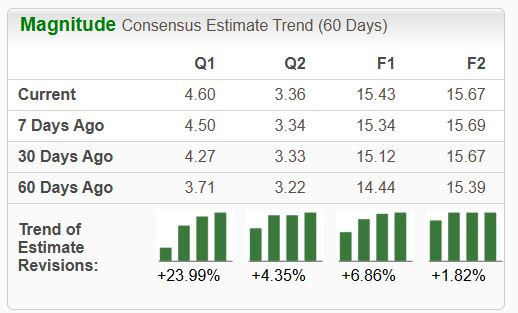

Previous quarterly releases have been overwhelmingly positive, with PGR exceeding the Zacks Consensus EPS estimate by an average of 18.5% across its last four releases. The stock is a Zacks Rank #2 (Buy), with earnings expectations moving higher across the board.

Image Source: Zacks Investment Research

Shares also provide a small level of passive income, with PGR shares currently yielding a modest 0.2% annually. Unlike other insurers, PGR shares aren’t commonly targeted among income-focused investors, but the raw share performance helps bridge that gap nicely.

AWK Shares Remain Strong

AWK shares have also shown relative strength in 2025, gaining 14% compared to the S&P 500’s 14% decline. Its latest set of quarterly results in mid-February perked shares up nicely, with the company exceeding both consensus EPS and sales expectations.

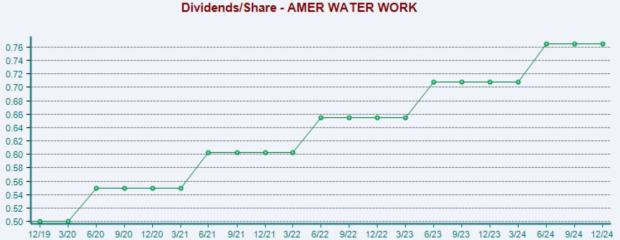

The company also reaffirmed previous guidance, adding to the positivity. Shares reflect the strongest play from an income standpoint, with the current 2.2% annual yield crushing that of the S&P 500. AWK has upped its payout five times over the past five years, translating to an 8.8% five-year annualized dividend growth rate.

Below is a chart illustrating the company’s dividends paid/share.

Image Source: Zacks Investment Research

Bottom Line

During periods of heightened volatility, low-beta stocks can provide a valuable layer of defense and a more balanced risk profile.

And over recent months, several low-beta stocks – The Progressive Corp. and American Water Works – have enjoyed positive earnings estimate revisions, landing them into favorable Zacks Ranks.

More By This Author:

Volatility Presents Opportunities: A Positive StanceThese 3 Stocks Are Ignoring The Market's Woes

Why Earnings Season Matters?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more