Equities begin the week firmer after the tariff reprieve for smartphones; Trump's walk-back capped gains - Newsquawk Europe Market Open

- Equities began the week with strength after the tariff reprieve for smartphones, though Trump's walk-back on this capped gains.

- Trump said there were no exceptions announced on Friday; Lutnick said semiconductor-tariffs in a month & pharma-tariffs in a month or two.

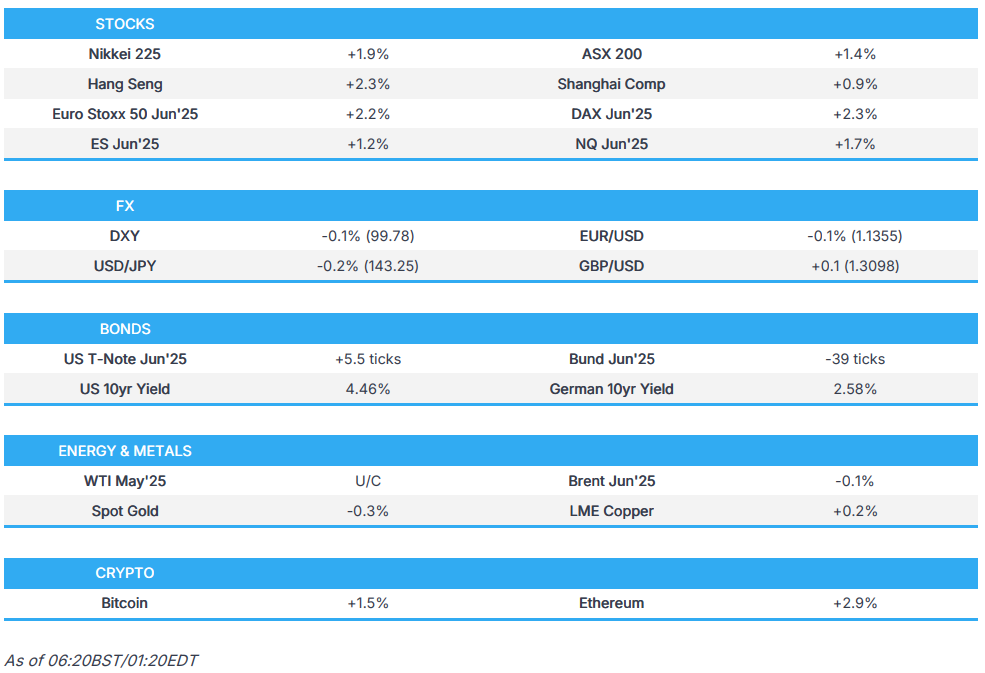

- DXY remained below the 100 mark, EUR/USD briefly surpassed 1.14 & Cable briefly surpassed 1.31.

- USTs attempted to nurse recent pressure but the constructive tone capped, Trump said the bond market is going good.

- Crude rangebound despite the tone as constructive US-Iran talks and remarks from Energy Sec. Wright offset this.

- Fed's Collins said they are likely moving to a period of difficult tradeoffs, and "we're not seeing liquidity concerns overall", via WSJ.

- Looking ahead, highlights include US NY Fed SCE. Speakers include RBNZ’s Conway, Fed’s Waller & Harker. Earnings from Goldman Sachs & LVMH.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks ultimately finished in the green on what was another choppy session last Friday and T-notes initially saw downward pressure in the wake of a dismal consumer confidence report accompanied by surging inflation expectations, while the latest PPI data was soft, in fitting with CPI, but sparked little reaction. Nonetheless, stocks and bonds recovered from the earlier lows into the closing bell, while on the US-China tariff front, China retaliated by raising the additional tariff on US goods to 125% from 84%.

- SPX +1.72% at 5,359, NDX +1.89% at 18,690, DJI +1.56% at 40,213, RUT +1.47% at 1,858.

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump’s administration exempted items from reciprocal tariffs including smartphones, storage devices and some other electronics. However, Trump posted on Sunday that there was no tariff exception announced on Friday and that these products are subject to the existing 20% fentanyl tariffs and are just moving to a different tariff bucket, while he stated that “NOBODY is getting “off the hook” for the unfair Trade Balances, and Non Monetary Tariff Barriers, that other Countries have used against us, especially not China which, by far, treats us the worst!”.

- US President Trump said he is to announce the tariff rate for semiconductors over the next week and that semiconductor tariffs will be in place in the not-distant future, while he added there will be some flexibility on some companies on semiconductor tariffs but it is not clear. Furthermore, Trump responded that they will be announced soon but there has to be some flexibility when asked about tariffs on Apple (AAPL) iPhones.

- US President Trump said the bond market is going good and had a little moment but he solved that problem very quickly. Trump added that the 10% tariff is a floor or pretty close and that it doesn’t matter if the dollar went down as he thinks it will go up and will be stronger than ever.

- US President Trump’s administration is reportedly prioritising trading partners that are strategic to China with the US in talks with Japan, South Korea, India and Vietnam, according to Politico.

- White House spokesperson said US President Trump made it clear America cannot rely on China to manufacture critical technologies such as semiconductors, chips, smartphones and laptops, while President Trump is to issue a Section 232 study on semiconductors soon and said he will have more information on semiconductors on Monday. Furthermore, Trump said that autos, steel, pharmaceuticals, chips and other specific materials will be included in specific tariffs to ensure tariffs are applied fairly and effectively.

- US Commerce Secretary Lutnick said President Trump plans a separate levy on exempted electronics amid a trade war with electronics products to be part of upcoming sectoral tariffs and that semiconductor and electronic tariffs will come in a month or so, while he added that pharmaceutical tariffs will be coming in the next month or two and that the US had “soft entrees” through intermediaries with China on tariffs.

- USTR Greer said there are no plans yet for President Trump to speak with Chinese President Xi and stated electronic exemptions reflect a move from reciprocal tariffs to national security tariffs. Greer said they have to be much more deliberate about the semiconductor supply chain and he believes the US will have meaningful tariff deals with several countries in the next few weeks.

- China said the US tariff exclusion is a small step for the US to correct its wrong practice and called for the US to completely cancel the levies.

- UK government announced that prices were slashed on 89 foreign products ranging from pasta, fruit juices and spices to plastic and gardening supplies over the next two years, while it stated the UK global tariff will be temporarily suspended on 89 products saving UK businesses at least GBP 17mln a year.

- UK retail bosses raised fears of Chinese product ‘dumping’ into the UK and European markets through platforms such as Temu, Shein and Amazon (AMZN) amid Trump tariffs, according to FT.

- Spain’s Economy Minister said the pause in US tariffs is an opportunity for dialogue.

NOTABLE HEADLINES

- Fed's Collins (2025 voter) said in a WSJ interview on Friday “There’s a real recognition that we are likely moving into a period where there may be some difficult trade-offs to make” while she added that high inflation from tariff increases that risk slowing the economy would create a “challenging environment” for the Federal Reserve that compels the central bank to wait for economic weakness to materialise before entertaining rate cut. Furthermore, Fed’s Collins told the FT on Friday that the Federal Reserve “would absolutely be prepared” to deploy its firepower to stabilise financial markets should conditions become disorderly, while she added that markets are continuing to function well" and "we're not seeing liquidity concerns overall".

- Some of the world’s largest pension funds from Canada and Denmark are reportedly halting or reassessing their private market investments in the US due to President Trump's erratic policy blitz, according to FT.

APAC TRADE

EQUITIES

- APAC stocks began the week on the front foot after reports of a tariff reprieve for smartphones and other electronic goods but with gains capped by President Trump's walk-back regarding this, while participants also digested somewhat mixed Chinese trade data.

- ASX 200 advanced at the open with real estate, health care and tech leading the broad gains seen in nearly all sectors.

- Nikkei 225 climbed above the 34,000 level with notable strength in pharmaceuticals and electronic goods/component manufacturers.

- Hang Seng and Shanghai Comp conformed to the positive risk environment amid some tariff-related reprieve with Chinese consumer electronic goods currently 20% fentanyl tariffs instead of the 145% reciprocal tariffs, although President Trump said he would be announcing the tariff rate for semiconductors over the next week and semiconductor tariffs will be in place in the not distant future. Furthermore, participants digest stronger lending data from China and mostly better-than-expected trade figures in which Trade Balance and Exports topped forecasts but Imports showed a wider-than-expected contraction.

- US equity futures gained at the open owing to the tariff relief, while participants look ahead to earnings releases stateside.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 2.6% after the cash market finished with losses of 0.7% on Friday.

FX

- DXY was pressured and retreated beneath the 100.00 level amid ongoing US tariff uncertainty after the Trump administration announced an exemption late last week for smartphones, data storage devices and some other electronics although President Trump backtracked on this over the weekend and stated there was no tariff exception announced on Friday and that these products are subject to the existing 20% fentanyl tariffs and are just moving to a different tariff bucket. Furthermore, he said he will announce the tariff rate for semiconductors over the next week and that semiconductor tariffs will be in place in the not-distant future.

- EUR/USD benefitted from the weaker dollar and briefly reclaimed the 1.1400 handle where it then met some resistance, with upside capped amid quiet EU-specific catalysts and with the ECB expected to cut rates later this week.

- GBP/USD marginally extended on last week's gains and returned to the 1.3100 territory, while the UK announced its global tariff will be temporarily suspended on 89 products with prices slashed on foreign products ranging from pasta, fruit juices and spices to plastic and gardening supplies over the next two years.

- USD/JPY retreated to a sub-143.00 level owing to the weaker dollar and in a continuation of last week's downward bias, but is off worst levels given the broad positive risk environment across Asia-Pac.

- Antipodeans marginally strengthened owing to the constructive mood and their high-beta characteristics although gains were capped as participants digested mixed Chinese trade data which showed double-digit exports growth and a contraction in imports.

- PBoC set USD/CNY mid-point at 7.2110 vs exp. 7.3251 (Prev. 7.2087).

FIXED INCOME

- 10yr UST futures attempted to nurse some of their recent losses but with the upside capped by resistance at the 110.00 level and amid the positive risk environment.

- Bund futures languished beneath the 131.00 level following last Friday's whipsawing and with little catalysts to boost prices.

- 10yr JGB futures clawed back early losses but with the upside limited by the lack of haven demand and the absence of tier-1 data from Japan.

COMMODITIES

- Crude futures traded rangebound with price action contained as tailwinds from the mostly positive risk appetite were offset following "very positive and constructive" talks between the US and Iran on Saturday, while there were bearish forecasts from Goldman Sachs and comments from the US Energy Secretary that there will be lower average oil prices over the next four years under the Trump administration.

- US Energy Secretary Wright said the US and Saudi Arabia will sign an agreement on energy investments and civilian nuclear technology, while he stated there will be lower average oil prices over the next four years under the Trump administration and he expects long-term cooperation between the US and Saudi to develop the civilian nuclear industry in the kingdom.

- Iraq signed an undersea oil exports pipeline deal with Italy’s Micoperi and Turkey’s Esta which will have a 2.4mln bpd capacity.

- Spot gold printed a fresh record high but remained within relatively tight parameters above the USD 3,200/oz level amid a softer dollar and with several bullish calls by the likes of Goldman Sachs, JPMorgan and UBS which have upgraded their outlook on the precious metal with Goldman Sachs forecasting prices to increase to USD 3,700 by year-end with an upside tail-risk of reaching USD 4,500/oz.

- Copper futures were underpinned amid the mostly constructive mood spurred by the smartphone and electronics tariff reprieve.

- US President Trump plans to stockpile deep sea metals to counter China, according to FT.

CRYPTO

- Bitcoin gained alongside the positive risk appetite and briefly rose back above the USD 85,000 level.

- Binance seeks to curb US oversight while in deal talks with Trump’s crypto company and has been in discussions to list a new dollar-pegged cryptocurrency from World Liberty Financial, according to WSJ.

NOTABLE ASIA-PAC HEADLINES

- China Customs said at present, China's exports are facing a complex and severe external situation, but added the sky will not fall and China is actively building a diversified market and deepening cooperation with all parties in the supply chain. Furthermore, it stated that importantly, China's domestic demand is broad and the import decline in the first quarter was mainly due to the decline in international product prices and fewer working days.

- China is to roll out more monetary easing steps with China to ramp up counter-cyclical policy adjustments and implement various monetary policy measures in the future, according to Shanghai Securities News.

- China may cut rates and RRR if the trade war hurts the economy, according to PBoC-backed Financial News citing former PBoC adviser Yu Yongding.

- Japanese senior LDP official Onodera said a weak yen has caused higher domestic living costs and Japan must strengthen the yen by making its companies stronger, while Onodera said that Japan, as a US ally, shouldn’t think about using its US treasury holdings as a negotiating tool in bilateral trade talks.

- Taiwan’s Financial Regulator announced short-selling stock curbs will be extended for another week.

- Monetary Authority of Singapore announced it will continue with the policy of a modest and gradual appreciation but slightly reduced the slope of the SGD NEER policy band as expected, while it maintained the width and level where the band is centred. MAS said imported and domestic cost pressures will remain low and its core inflation is forecast to stay well below 2%, while risks to inflation are tilted towards the downside.

DATA RECAP

- Chinese Trade Balance (USD)(Mar) 102.64B vs. Exp. 77.0B (Prev. 170.52B)

- Chinese Exports YY (Mar) 12.4% vs. Exp. 4.4% (Prev. 2.3%)

- Chinese Imports YY (Mar) -4.3% vs. Exp. -2.0% (Prev. -8.4%)

- Chinese Yuan-Denominated Trade Balance (Mar) 736.72B (Prev. 228.19B)

- Chinese Yuan-Denominated Exports (Mar) 13.5% (Prev. -1.9%)

- Chinese Yuan-Denominated Imports (Mar) -3.5% (Prev. 2.5%)

- Chinese New Yuan Loans (CNY)(Mar) 3.64T vs Exp. 3.00T (Prev. 1.01T)

- Chinese Aggregate Financing (CNY)(Mar) 5.89T vs Exp. 4.80T (Prev. 2.23T)

- Chinese Money Supply M2 YY (Mar) 7.0% vs Exp. 7.1% (Prev. 7.0%)

- Singapore GDP QQ (Q1 A) -0.8% vs Exp. -0.4% (Prev. 0.5%)

- Singapore GDP YY (Q1 A) 3.8% vs Exp. 4.3% (Prev. 5.0%)

GEOPOLITICS

- Israel bombed a Gaza hospital as its military expanded its offensive, according to FT.

- Israeli military said sirens sounded in several areas in Israel and interception attempts were made after two missiles were launched from Yemen.

- US President Trump said Iran talks are going well and that Ukraine-Russia talks might be going okay but added there is a time when you have to put up or shut up. Furthermore, Trump separately commented that they will be making a decision on Iran shortly, while the White House said Iran discussions were very positive and constructive, as well as noted that the sides agreed to meet again next Saturday and US special envoy Witkoff underscored to Iran’s Foreign Minister that he had instructions from President Trump to resolve differences through dialogue and diplomacy if possible.

- Iran’s Foreign Minister Araqchi said both sides want an agreement in the short-term and not ‘talks for talks’, while he added the second round of talks will probably be next Saturday.

RUSSIA-UKRAINE

- Ukraine’s air force said on Saturday morning that Russia launched 88 drones in an overnight attack and announced on Sunday that Russia launched 55 drones targeting Ukraine, while the mayor of Ukraine's Sumy said over 20 were killed after a Russian missile strike on the city.

- Russian Defence Ministry said Russian forces captured Yelyzavetivka in eastern Ukraine and Russian air defence systems shot down a Ukraine F-16 jet, according to Interfax. It was also reported that Russia accused Ukraine of attacking its energy infrastructure on several occasions over the weekend.

- Russian Foreign Minister Lavrov said they have been keeping their word on a 30-day energy strikes moratorium and there were no direct or indirect contacts between Russia and Ukraine at the Antalya Forum. It was also reported that Turkish and Russian Foreign Ministers discussed efforts to achieve a ceasefire in the Russia-Ukraine war.

- Russia’s Kremlin said relations with the US are moving ahead very well and mutual visits by Russian and US envoys are very good reliable channels for communicating positions to each other.

- Military representatives from Turkey and foreign nations are to meet in Turkey on April 15th-16th to discuss Black Sea security after a possible ceasefire between Ukraine and Russia, according to the Turkish Defence Ministry.

- German Chancellor-in-waiting Merz said Germany is willing to send Taurus missiles to Ukraine, according to FT.

EU/UK

NOTABLE HEADLINES

- UK reportedly races to secure coal required to keep British steel furnaces, according to FT.

- S&P raised Italy’s sovereign rating by one notch to BBB+ from BBB; Outlook Stable.

DATA RECAP

- UK House Price Rightmove MM (Apr) 1.4% (Prev. 1.1%)

- UK House Price Rightmove YY (Apr) 1.3% (Prev. 1.0%)