Overview of Harris Central Appraisal District: Budget, Parcels, and ARB

Insights from O'Connor's Analysis of 2022 Harris Central Appraisal District: Budget, Parcels, and ARB.

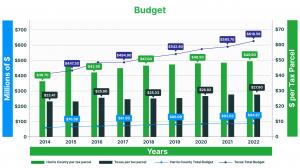

HOUSTON, TEXAS , UNITED STATES, April 12, 2024 /EINPresswire.com/ -- The 2022 budget for the Harris Central appraisal district (HCAD) amounted to $94.87 million, while the budget for the Harris County appraisal review board (ARB) portion was $3.58 million. HCAD’s budget translates to approximately $49 per tax parcel, based on the 1,902,200 tax parcels in 2021. Notably, HCAD’s budget is 85% higher than the statewide average of $27 for 2022. The collective budget for appraisal districts across Texas in 2022 was $618 million.

Appraisal district Budgets

The Harris Central Appraisal district had a budget of $94,870,000, which was the highest statewide budget. Followed by the Tarrant appraisal district which had a budget of $25,500,000, Collin Central appraisal district trailed with $23,500,000, and the Travis Central appraisal district budget totaled $20,200,000.

The budget of the Harris Central Appraisal district experienced an increase of 48% from 2011 to 2021. Starting at $63.76 million in 2011, the HCAD budget climbed to $94.87 million by 2022.

The Harris County appraisal review board budget totaled $3.58 million in 2022, higher than any other county.

In the tax year 2022, the Harris County Appraisal Review Board obtained the largest portion among all counties, totaling $3.58 million. Tarrant County ARB planned budgets at $1.44 million, Travis County ARB had $1.20 million, Fort Bend County ARB secured $1.09 million, and Dallas County ARB obtained $1.07 million.

The Harris Central Appraisal District has experienced a modest increase in staffing over the years, rising from 630 employees in 2011 to 672 in 2022. Additionally, the number of appraisers employed by the district has grown somewhat, reaching 307 in 2022 compared to 267 in 2013. Notably, the district remains fully staffed compared to statewide averages for similar districts.

Tax Parcels per Employee – Harris Central Appraisal district versus Texas

There are 2,830 tax parcels per employee at Harris Central appraisal district versus a statewide average of 4,579 tax parcels per appraiser, both for 2022.

Tax Parcels per Appraiser – HCAD versus Texas

In the Harris Central Appraisal District, there is one appraiser employed for every 6,196 accounts, compared to 9,730 statewide.

Harris Central Appraisal district appraiser allocation follows:

In the Harris Central Appraisal District, 142 appraisers are specializing in residential properties, 61 appraisers are dedicated to commercial properties, and 104 appraisers are responsible for all other property types. The total number of Full-Time Employees (FTE) appraisers is 307.

Appraisal district Employee Allocation – HCAD versus Texas

Statewide appraisal districts allocated their appraisers as follows:

Within the Statewide Appraisal District, the 2,278 appraisers serve diverse functions: 67% specialize in residential appraisals (1,527 appraisers), 22% in commercial appraisals (498 appraisers), and 11% in various other types of appraisals (253 appraisers). These roles collectively constitute 100% of the total Full-Time Employees (FTE) dedicated to appraisals.

Appraiser versus Administrative Staff at Harris Central Appraisal District

When comparing data compiled by the Texas Comptroller, it is evident that the Harris Central Appraisal District has a higher proportion of administrative/operations staff relative to appraisers. Specifically, HCAD’s staff allocation consists of approximately 45% appraisers and 55% administrative staff. In contrast, statewide staff allocation at other appraisal districts averages at 52% appraisers and 48% administrative staff.

Appraisal district Appraiser Allocation

Harris County allocates its appraisal resources more heavily toward commercial, industrial, and business personal property compared to other Texas appraisal districts. While only 46% of Harris County appraisers are tasked with valuing houses, 67% of appraisers statewide focus on residential properties. Similarly, in the commercial sector, 22% of appraisers statewide concentrate on commercial properties, whereas 20% of Harris County appraisers are involved in commercial valuations. Moreover, Harris County dedicates 34% of its appraisers to industrial and business personal property. This allocation aligns with the significant presence of industrial, refining, and petrochemical facilities and infrastructure in Harris County.

Revaluation Cycle

Harris County consistently revalued every parcel annually from 2014 to 2022, whereas statewide appraisal districts only revalued approximately 80 to 90% of parcels during the same period. This frequent reassessment of tax valuations sets Texas apart from most states, where reassessments typically occur every 3 to 6 years.

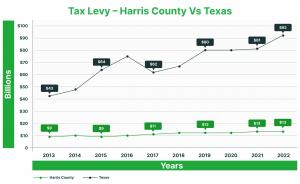

Tax Levy – Harris County versus Texas

The total Harris County property tax levy rose from $9 billion in 2013 to $13 billion in 2022, a 33% increase. The per capita property tax levy rose more quickly than population, indicating a high rate of property tax growth, which eventually in Senate Bill 2 which capped the property tax levy growth to 3.5% for cities and counties (3.5% plus new construction) and 2.5% for schools plus new construction.

Texas Levy Growth

The statewide tax levy in Texas surged from $43 billion in 2013 to $90 billion in 2022, marking a staggering 109% increase. This growth significantly outpaced population growth and inflation. Consequently, the tax level per person skyrocketed by 88% from 2013 to 2022.

Harris County versus Texas Per Capita Property Tax Growth

Harris County’s per capita property taxes experienced a 30% increase from 2013 to 2022, contrasting with the 88% growth statewide. Specifically, the per capita property tax in Harris County rose from $2,068 in 2013 to $2,713 in 2022. While the statewide per capita tax levy initially began at a lower rate, the rapid growth ultimately aligned it with the levels seen in Harris County. In 2021, the property tax levy per person in Harris County stood at $2,713, compared to $3,076 statewide in 2022.

ARB Staffing – Harris County versus Texas

Harris County has a higher staffing level for appraisal review board members compared to the statewide average. Harris County Appraisal review board has 16,686 tax parcels per appraisal review board (ARB) member versus 11,771 statewide. This makes sense since HCAD has made liberal use of the appraisal review board.

ARB Compensation – Harris County and Texas-wide

COVID Impact on appraisal review board Staffing

A considerable portion of the Appraisal review board (ARB) members are retirees, which elevates their vulnerability to severe health implications should they contract COVID-19. Consequently, the Harris County Appraisal review board witnessed a substantial reduction in its membership, dwindling from 190 members in 2019 to approximately 115 by October 2023, representing a 40% decrease.

ARB Days of Hearings

Appraisal Review Boards (ARBs) compensate members to adjudicate tax protests unresolved during informal hearings. In Texas’ largest counties, ARBs convene for an extended period, often spanning five to six days a week over many months. In 2021, Harris County and Hays County tied for the highest number of ARB hearings with 158 days each. The subsequent highest counts were Comal – 100 days, El Paso – 97 days, Tarrant – 90 days, Johnson – 86 days, Montgomery – 82 days, Victoria – 80 days, Travis – 71 days, and Galveston – 73 days.

Why More ARB Hearings in Some Counties

The appraisal review board represents the second step in a three-step process, preceded by the informal hearing and appraisal review board hearings, collectively termed “administrative hearings.” After these hearings, property owners can choose: 1) binding arbitration, 2) judicial appeal, 3) State Office of Administrative Hearings (SOAH) or take no further action. Roughly 98% of owners opt for no further action after the appraisal review board.

Practice Tip: consider continuing after the appraisal review board annually.

Appraisal districts generally receive tax protests for approximately 10 to 25% of tax parcels, comprising 38% of statewide value. In Harris County, property owners file tax protests for about 24% of tax parcels, accounting for 58% of the total value. More valuable homes are often subject to protests. Additionally, protests involving commercial, industrial, and business personal property are common occurrences in most years.

Owners Who Don’t Protest

Entry-level and mid-range housing property owners are frequently overlooked in property tax appeals, contrasting with the consistent annual protests by large commercial property owners. This underscores their conviction in the vital role of property tax protests for effective tax management, as opposed to passively accepting values generated by the appraisal district’s computer. Nonetheless, many large commercial property owners only participate in the administrative process, neglecting the full extent of their obligations.

Owners of Commercial Valued over $750,000

Most owners of commercial properties are advised to continue with the appeal process beyond the administrative hearings (informal and appraisal review board). Based on data compiled by the Texas Comptroller and provided by the appraisal district, there is an approximate 90% chance of achieving an additional 10% reduction. It’s important to clarify that these findings are not specific to our accounts but rather reflect statewide aggregate judicial appeal results.

Who is Watching Your Interests?

Harris Central Appraisal district operates with a budget exceeding $94 million, supplemented by an additional $3.5 million allocated for the ARB, to meticulously assess the 1.90 million tax parcels in Harris County. As of 2022, Harris County employed a total staff of 672 individuals, inclusive of 307 appraisers. While HCAD remains dedicated to ensuring properties are assessed at 100% of market value, it prompts the question: what measures are taken if this benchmark is exceeded?

Can You Afford An Ally to Look Out for Your Interests?

How does Harris Central Appraisal district (HCAD) overvalue property?

HCAD conducts assessments on 1.90 million tax parcels annually through mass appraisal techniques. Periodically, typically every three years, each property undergoes an “inspection” utilizing aerial photography, albeit with limitations in information acquisition. The district employs “mass appraisal models” despite incomplete property data for valuation purposes. Notably, while some properties are valued below 100% (and remain subject to appeal based on unequal appraisal), others are assessed at values exceeding 100% of market value.

Are You Undervalued or Overvalued?

To determine whether your property is over or undervalued, you’ll need to:

Submit a protest before the May 15th deadline each year.

Ask for the hearing evidence that the appraisal district intends to present (this also locks in the information they can use).

Get ready for and attend the informal hearing (around 70 to 90% are resolved with a reduction).

Proceed to the appraisal review board and beyond if needed.

Practice tip: Your property tax assessment cannot be increased during an informal appraisal review board hearing.

What does HCAD Valuation at 100% Mean?

When Harris Central Appraisal district assigns properties a median assessment level of 100% relative to market value, it indicates:

Approximately half of all properties are assessed with values exceeding their market worth. This data forms a bell curve when plotted, showing varying degrees of undervaluation and overvaluation.

Properties undervalued by approximately 50% are still viable candidates for protest based on both market value and unequal appraisal. When filing a protest, request the hearing evidence package from the appraisal district. Often, HCAD’s comparable sales data will include relevant sales, though checking your street or neighborhood for assessment comparable may be necessary to support a reduction.

Protests can be made on the grounds of either market value (when the property is assessed above its true market worth) or unequal appraisal. The latter involves demonstrating that a reasonable number of comparable properties, properly adjusted, suggest a lower value. Regardless of the basis of protest, a lower tax assessment results in reduced property taxes.

What if You Don’t Have Time or the Temperament to Protest?

Consider hiring us or a competitor for your property tax protest needs. Consistent protesting leads to lower taxes, with even a one-year reduction impacting future negotiations.

Here are O’Connor’s benefits:

No Hidden Fees: There’s no flat fee, upfront cost, or filing fees EVER. You’ll only pay a portion of your savings.

Seamless Enrollment: Enroll online in just 3 minutes without any fees or credit card required. Alternatively, feel free to contact us by phone.

Get live support from our trained property tax experts. Our customer service team successfully handled more than 99% of inbound calls.

O’Connor dominates tax appeals in Texas, covering around 180 counties. We employ aggressive strategies like binding arbitration, judicial appeals, and coordination with the State Office of Administrative Appeals.

Our core purpose at O’Connor is to improve the lives of property owners through cost-effective tax reduction. In 2023 alone, we saved property owners $1224 million in property taxes and $400 million in federal income taxes by preparing cost segregation reports to increase property owners’ depreciation, thereby reducing their federal and state income taxes.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.