Embedded Die Packaging Market Size to Reach USD 609.4 Million by 2033, Growing at a CAGR of 20.54%

Embedded Die Packaging Market Growth Analysis

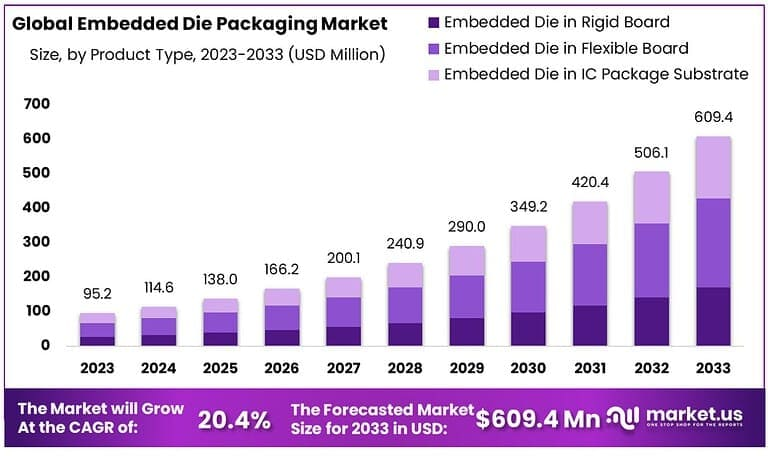

Embedded Die Packaging Market is expected to grow from USD 95.2 million in 2023 to USD 609.4 million by 2033, expanding at a CAGR of 20.54%.

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- **Report Overview**

The Global Embedded Die Packaging Market is projected to reach USD 609.4 million by 2033, growing from USD 95.2 million in 2023, at a CAGR of 20.54% from 2024 to 2033.

Embedded die packaging (EDP) is an advanced semiconductor packaging technology where die (chips) are directly embedded into substrates or circuit boards, instead of being mounted on the surface. This process integrates the die within the packaging structure, allowing for improved electrical and thermal performance while minimizing the overall package size. EDP is particularly advantageous in applications where space and performance are critical, such as in automotive, consumer electronics, and IoT devices. It enables enhanced signal integrity, reduced power consumption, and better heat dissipation, making it an ideal solution for next-generation electronics.

The embedded die packaging market has been witnessing significant growth, driven by the increasing demand for smaller, more efficient electronic devices. As consumer electronics, automotive, and industrial sectors continue to push the envelope on performance and miniaturization, the need for advanced packaging technologies like EDP has surged. The market is further fueled by the rise in demand for 5G connectivity, AI applications, and wearable technology, all of which require high-performance chips that can operate in constrained spaces.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/embedded-die-packaging-market/request-sample/

Several growth factors are propelling the market forward, including the ongoing trend of miniaturization, the demand for more powerful yet compact electronics, and advancements in materials science. Opportunities in the market are vast, as industries seek to improve the functionality, reliability, and efficiency of their products. As these sectors evolve, embedded die packaging is expected to play a critical role in enabling the next generation of high-performance, space-constrained electronic devices.

**Key Takeaways**

~~ The Embedded Die Packaging Market is poised for significant growth, propelled by the increasing demand for miniaturization and high-performance electronics across multiple industries.

~~ In 2023, Embedded Die in Flexible Board dominated the market, accounting for 42.4% of the share. This product is favored for its lightweight, space-efficient, and flexible design, making it ideal for consumer electronics, wearables, and medical implants.

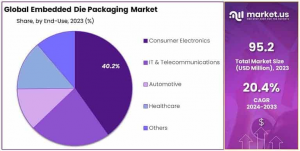

~~ The Consumer Electronics segment led the market in 2023, capturing over 40.2% of the market share. The need for miniaturized, high-performance devices has made embedded die packaging essential in this sector.

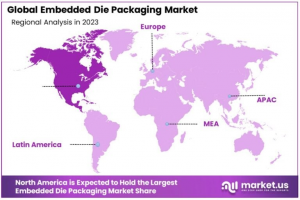

~~ North America leads the market with a 30.9% share, driven by strong demand in various sectors. Europe follows, focusing on automotive and medical devices, while Asia Pacific experiences rapid growth due to investments in electronics manufacturing and 5G technologies.

**Market Segmentation**

In 2023, the Embedded Die in Flexible Board segment dominated with a 42.4% market share, valued for its space efficiency and design flexibility, especially in consumer electronics and wearables. Embedded Die in Rigid Board was essential for applications requiring strong structural integrity and thermal conductivity, though it faced competition from more flexible technologies. Meanwhile, Embedded Die in IC Package Substrate, despite its higher cost and complexity, saw growing demand due to its performance benefits for high-speed data and advanced computing, fueled by the expansion of IoT devices.

In 2023, the Consumer Electronics segment dominated the market with over 40.2% share, driven by the demand for compact, efficient devices like smartphones, tablets, and wearables, where embedded die packaging enables miniaturization and superior thermal management. The IT & Telecommunications sector also saw significant adoption, driven by the need for efficient, high-performance packaging in servers, networking devices, and telecommunications equipment, fueled by trends like 5G and cloud computing. Meanwhile, the Automotive sector is rapidly growing, with embedded die packaging playing a key role in advancing automotive electronics, including ADAS, infotainment, and electric vehicle systems, by offering durability, improved thermal management, and reduced form factors to meet industry demands.

**Key Market Segments**

By Product Type

~~ Embedded Die in Flexible Board

~~ Embedded Die in Rigid Board

~~ Embedded Die in IC Package Substrate

By End-Use

~~ Consumer Electronics

~~ IT & Telecommunications

~~ Automotive

~~ Healthcare

~~ Others

**Driving factors**

Increasing Demand for Compact Electronics

The global Embedded Die Packaging market is experiencing substantial growth, driven by the increasing demand for smaller, more efficient electronic devices. With the ongoing trend toward miniaturization in consumer electronics, automotive, and telecommunications, manufacturers are increasingly adopting embedded die packaging solutions to meet the need for reduced component sizes and improved performance. As consumer devices, such as smartphones, wearables, and tablets, continue to evolve, the desire for smaller form factors and enhanced functionality is driving the demand for packaging solutions that enable these advancements. Embedded die packaging allows for a higher degree of integration, where multiple components, such as sensors, processors, and memory, can be placed within a compact space, thus improving overall device performance without compromising on size.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=49324

**Restraining Factors**

High Manufacturing and Development Costs

One of the key restraints limiting the growth of the Embedded Die Packaging market is the high manufacturing and development costs associated with this technology. Although embedded die packaging offers several advantages in terms of miniaturization and performance, the upfront costs for design, prototyping, and production can be significantly higher than traditional packaging methods. This can be a major challenge for smaller manufacturers or companies with limited budgets, as the cost of adopting this advanced packaging technology may outweigh the potential benefits. Furthermore, the complexity involved in embedding dies within substrates and ensuring the structural integrity and performance of the final product requires specialized equipment and expertise, leading to additional costs.

**Growth Opportunity**

Growing Adoption in Automotive and Industrial Sectors

A significant opportunity for growth in the Embedded Die Packaging market lies in its increasing adoption within the automotive and industrial sectors. As the automotive industry moves towards more advanced technologies, such as electric vehicles (EVs), autonomous driving, and connected vehicle systems, the need for compact, reliable, and high-performance electronic components has never been greater. Embedded die packaging solutions offer a unique advantage in these applications due to their ability to integrate multiple components into a small, efficient package that can withstand extreme environmental conditions. This is particularly crucial for automotive electronics, where reliability and durability are essential for safety and performance.

**Latest Trends**

Advancements in 3D Packaging Technologies

One of the most notable trends in the Embedded Die Packaging market is the rapid advancement of 3D packaging technologies. These innovations allow for the vertical stacking of multiple semiconductor dies in a single package, facilitating even greater miniaturization and performance optimization. As the need for high-speed processing and multi-functional capabilities in electronic devices continues to rise, 3D packaging presents a promising solution by offering enhanced interconnectivity between different components while maintaining a compact form factor. This trend is particularly relevant in sectors like consumer electronics, telecommunications, and data centers, where high-density integration and fast processing speeds are crucial.

**Regional Analysis**

The North America region leads the global embedded die packaging market, holding a 30.9% share in 2023, driven by strong semiconductor manufacturing, technological advancements, and high demand across sectors like automotive and consumer electronics. Europe follows with significant contributions from the automotive and aerospace industries, where demand for compact, high-performance solutions is rising, particularly in Germany, France, and the UK.

The Asia Pacific region is poised for the highest growth rate, with major markets like China, Japan, and South Korea expanding rapidly due to their dominance in semiconductor production and increasing adoption of embedded packaging in consumer electronics and automotive sectors. Middle East & Africa are seeing gradual market development, supported by investments in smart manufacturing and telecommunication infrastructure, while Latin America is experiencing moderate growth, driven by rising electronics demand in Brazil and Mexico.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

In 2024, the Global Embedded Die Packaging Market will continue to be driven by a strong presence of key players across the semiconductor and electronics industries. Microsemi Corporation is expected to leverage its advanced solutions for high-performance embedded die packages, particularly in aerospace and defense sectors. Fujikura Ltd. stands poised to capitalize on its expertise in electronic materials and interconnect solutions, maintaining a competitive edge. Infineon Technologies AG will likely expand its footprint with its innovative semiconductor solutions for automotive and industrial applications.

ASE Group, AT&S Company, and Amkor Technology are key contenders, with their robust packaging capabilities meeting increasing demand for miniaturization and high-density packaging. Intel Corporation and Taiwan Semiconductor Manufacturing Company (TSMC) will lead with their cutting-edge technologies in chip manufacturing and embedded packaging, driving adoption of advanced systems. TDK Corporation, Schweizer Electronic AG, and General Electric are expected to further diversify their offerings, positioning themselves strongly in automotive, consumer electronics, and energy sectors.

Top Key Players in the Market

~~ Microsemi Corporation

~~Fujikura Ltd.

~~Infineon Technologies AG

~~ASE Group

~~AT&S Company

~~Schweizer Electronic AG

~~Intel Corporation

~~Taiwan Semiconductor Manufacturing Company

~~TDK Corporation

~~General Electric

~~Shinko Electric Industries Co. Ltd

~~Amkor Technology

**Conclusion**

The Global Embedded Die Packaging Market is on a robust growth trajectory, projected to reach USD 609.4 million by 2033, driven by the increasing demand for compact, high-performance electronics across sectors like consumer electronics, automotive, and telecommunications. While the technology faces challenges such as high manufacturing costs, its advantages in miniaturization, improved performance, and enhanced thermal management make it essential for next-generation electronic devices. The market is expected to see significant advancements, especially with trends like 3D packaging and expanding adoption in industries like automotive and healthcare. North America and Asia Pacific will continue to lead the market, with key players such as Microsemi, Infineon, and TSMC driving innovation and market growth

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Consumer Goods

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release