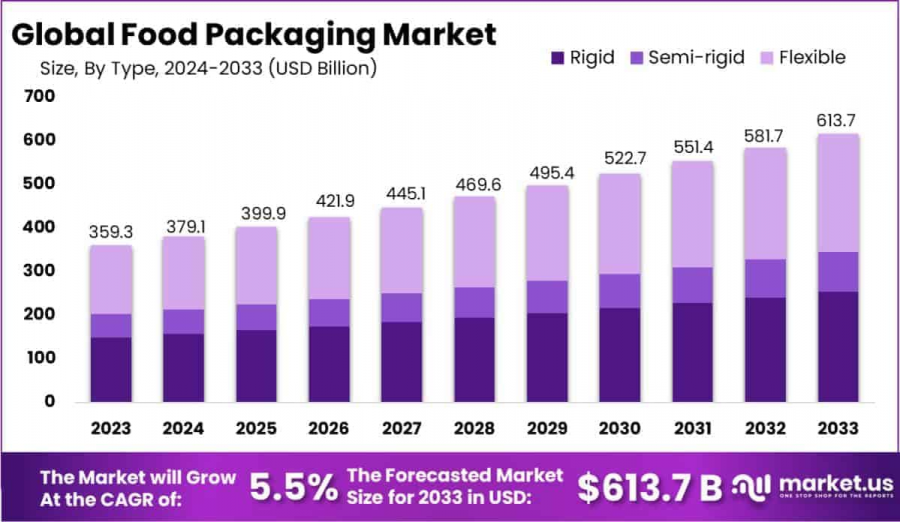

Food Packaging Market Share to Reach USD 613.7 Billion by 2033, CAGR of 5.5%

Food Packaging Market is projected to reach USD 613.7 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033, driven by rising consumer demand.

NEW YORK, NY, UNITED STATES, January 29, 2025 /EINPresswire.com/ -- **Report Overview**

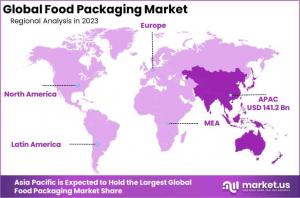

The Global Food Packaging Market is projected to reach approximately USD 613.7 billion by 2033, rising from USD 359.3 billion in 2023. This represents a CAGR of 5.5% from 2024 to 2033. In 2023, the Asia Pacific region led the market with a 39.3% share, generating USD 141.2 billion in revenue from food packaging.

Food packaging refers to the materials and processes used to contain, protect, and preserve food products from external factors while maintaining their quality and safety. It encompasses a wide range of packaging formats, from simple wrappers and containers to complex, multi-layered structures designed to extend shelf life and enhance the visual appeal of the product. Food packaging plays a critical role in consumer convenience, product branding, and supply chain efficiency. The use of innovative materials, such as biodegradable plastics, and advanced technologies, like modified atmosphere packaging (MAP), has been driving industry evolution in response to growing sustainability concerns and changing consumer preferences.

The food packaging market is a dynamic and essential segment of the global food and beverage industry. It is driven by increasing consumer demand for convenient, safe, and sustainable packaging solutions. The market is expected to continue its growth trajectory as food producers and retailers seek to meet rising consumer expectations and comply with stringent regulatory requirements regarding food safety, labeling, and environmental impact. Key drivers of growth include the rising preference for packaged and processed foods, the adoption of eco-friendly packaging alternatives, and innovations in packaging technologies that improve functionality, reduce waste, and preserve product integrity.

Request Your Sample Report Today for In-Depth Insights and Analysis at https://market.us/report/food-packaging-market/request-sample/

The demand for food packaging is fueled by global trends such as urbanization, busy lifestyles, and growing concerns about food safety and sustainability. Opportunities within the market abound, particularly for companies that can capitalize on innovations in sustainable materials, digital printing for personalization, and smart packaging technologies that provide real-time tracking and enhanced consumer engagement.

**Key Takeaways**

~~ The global food packaging market is projected to reach USD 613.7 billion by 2033, up from USD 359.3 billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2024 to 2033.

~~ In 2023, the Flexible segment dominated the market with a 44.3% share in the Food Packaging market.

~~ Plastics led the market in 2023, holding a 40% share in the Food Packaging market.

~~ The Bakery & Confectionery segment held the largest market share in 2023, accounting for 28.3% of the Food Packaging market.

~~ The Asia Pacific region led the market in 2023, with a 39.3% market share, generating USD 141.2 billion in revenue from the Food Packaging market.

**Market Segmentation**

In 2023, flexible packaging led the Food Packaging Market with a 44.3% share due to its versatility, cost-effectiveness, and ability to support extended shelf life and convenience. Rigid packaging followed with 33.4%, valued for its robustness and superior protection, especially for delicate products. Semi-rigid packaging, combining flexibility and sturdiness, captured 22.3% of the market, appealing to ready-to-eat meal segments for its convenience and protective qualities. These segments' dominance reflects consumer demands for durability, convenience, and sustainability, prompting continuous innovation in the industry.

In 2023, Plastics led the Food Packaging Market with a 40% share, due to its cost-effectiveness, versatility, and ability to preserve freshness. Paper & Paper-based materials followed with a 30% share, driven by growing demand for sustainable packaging. Metal packaging captured 15% of the market, valued for its durability and barrier properties, while Glass held 10%, often used for premium products. The remaining 5% was made up of innovative materials like bioplastics and edible packaging, reflecting the trend toward sustainability in the industry.

In 2023, the Food Packaging Market was primarily driven by Bakery & Confectionery, which held the largest share at 28.3%, due to high demand for packaging that preserves freshness and enhances shelf appeal. Dairy Products followed with 22%, driven by cold chain requirements, while Fruits & Vegetables accounted for 18.5%, with packaging focused on reducing food waste. Meat, Poultry, & Seafood made up 15%, with innovations geared towards freshness preservation, and Sauces & Dressings captured 10.2%, emphasizing convenience and portion control. The remaining 6% was attributed to other food applications, highlighting the varied packaging needs across the market.

**Key Market Segments**

By Type

~~Rigid

~~Semi-rigid

~~Flexible

By Material

~~Paper & Paper-based Material

~~Plastics

~~Metal

~~Glass

~~Others

By Application

~~ Bakery & Confectionary

~~Dairy Products

~~Fruits & Vegetables

~~Meat, Poultry, & Seafood

~~Sauces & Dressings

~~Others

**Driving factors**

Sustainable Packaging Solutions

The growing consumer demand for eco-friendly products is significantly driving the global food packaging market. As environmental awareness rises, there is a strong shift towards biodegradable, recyclable, and compostable materials. This trend is pushing companies to innovate and adopt sustainable packaging solutions, which are not only beneficial for the environment but also align with consumer preferences for greener alternatives. This demand for sustainability is expected to fuel market growth in the coming years.

"Order the Complete Report Today to Receive Up to 30% Off at https://market.us/purchase-report/?report_id=12988

**Restraining Factors**

High Cost of Sustainable Packaging

While sustainable packaging solutions are gaining traction, their high cost remains a significant restraint. The production of eco-friendly materials often involves more expensive raw materials and advanced manufacturing processes, which increase overall production costs. These higher costs are passed onto consumers, making eco-friendly packaging less competitive compared to conventional alternatives. This pricing challenge could limit widespread adoption, especially in price-sensitive markets, hindering the growth potential of the food packaging industry.

**Growth Opportunity**

Advancements in Smart Packaging Technologies

Smart packaging is poised to be a major opportunity within the food packaging market. Incorporating technologies like RFID tags, sensors, and QR codes allows food companies to improve product tracking, enhance freshness, and boost consumer engagement. Smart packaging solutions also offer enhanced shelf life through real-time monitoring of conditions, reducing food waste and improving supply chain efficiency. As this technology becomes more accessible and cost-effective, it represents a significant opportunity for growth and innovation in the food packaging sector.

**Latest Trends**

Shift Towards Minimalist Packaging Design

Minimalist packaging design is becoming a prominent trend in the food packaging industry. Consumers are increasingly gravitating toward packaging that is simple, aesthetically pleasing, and functional, with less emphasis on excessive branding or decoration. This trend not only reduces the environmental impact by using fewer materials but also appeals to modern consumer preferences for simplicity and clarity in product presentation. As the demand for minimalistic designs rises, this trend is shaping the evolution of food packaging solutions.

**Regional Analysis**

Asia Pacific Leads the Food Packaging Market with the Largest Market Share of 39.3% in 2023

The Food Packaging Market is witnessing significant regional variations, with Asia Pacific holding the dominant position in 2023, accounting for 39.3% of the global market share, valued at USD 141.2 billion. This dominance is attributed to the region's strong manufacturing base, rapid urbanization, and increasing demand for packaged food products.

North America is a major contributor to the market as well, driven by robust consumer demand for convenience and health-conscious packaging solutions. The region holds a substantial share, supported by stringent regulatory frameworks and innovations in sustainable packaging materials.

Europe follows closely, with key trends revolving around eco-friendly packaging and regulatory pressures to reduce plastic usage. Countries like Germany, France, and the UK are at the forefront, implementing various initiatives for reducing carbon footprints in packaging.

The Middle East & Africa region is witnessing growth, albeit at a slower pace. Increased disposable income and changing lifestyles are fueling demand for packaged food, with the market expanding mainly in regions like the UAE and South Africa.

Latin America, while still emerging, is gradually gaining ground in the food packaging sector, driven by urbanization and the growing popularity of ready-to-eat meals, particularly in Brazil and Mexico.

In conclusion, Asia Pacific remains the leading region, and its dominance is expected to continue due to rapid industrial growth and a high demand for food packaging solutions in emerging economies.

!! Request Your Sample PDF to Explore the Report Format !!

**Key Players Analysis**

In 2024, the global food packaging market will continue to witness strong competition among key players such as Mondi Group, Amcor PLC, and Constantia Flexibles. These companies are focusing on innovative, sustainable packaging solutions to meet rising consumer demand for eco-friendly materials. Industry leaders like Tetra Pak International S.A., DS Smith, and Crown Holdings, Inc. are investing heavily in advanced technologies like smart packaging and biodegradable materials.

Pactiv LLC, Coveris Group, and Winpak LTD maintain strong positions with versatile packaging portfolios, while Alpha Packaging, Ball Corporation, and Berry Global Inc. expand their presence through strategic acquisitions. Smurfit Kappa and others contribute through comprehensive sustainability initiatives, shaping the market’s future landscape.

Top Key Players in the Market

~~ Mondi Group

~~ Amcor PLC

~~ Constantia Flexibles

~~ Plastipak

~~ Tetra Pak International S.A.

~~ DS Smith

~~ Crown Holdings, Inc.

~~ Pactiv LLC

~~ Coveris Group

~~ Winpak LTD

~~ Alpha Packaging

~~ Ball Corporation

~~ Berry Global Inc.

~~ Smurfit Kappa Group PLC

~~ Other Key Players

**Recent Developments**

~~ In June 2023, Tetra Pak International S.A. acquired a smaller packaging company to expand its capabilities in biodegradable materials, enhancing its position in sustainable packaging solutions for food sectors.

~~ In May 2023, Plastipak launched a new line of recyclable PET containers to support sustainability and address the rising consumer demand for eco-friendly packaging.

~~ In April 2023, DS Smith introduced a new range of fully recyclable packaging for temperature-sensitive food products, reinforcing its commitment to sustainability and specialized packaging solutions.

**Conclusion**

The global food packaging market is projected to grow from USD 359.3 billion in 2023 to USD 613.7 billion by 2033, with a CAGR of 5.5%. The market is driven by rising consumer demand for convenient, safe, and sustainable packaging solutions, particularly in the Asia Pacific region, which held the largest market share of 39.3% in 2023. Key trends include the shift toward eco-friendly packaging, innovations in smart packaging technologies, and the increasing demand for minimalist designs. While high costs associated with sustainable packaging remain a challenge, advancements in smart packaging and consumer preferences for sustainability present significant growth opportunities. Major players in the market, such as Mondi Group, Amcor, and Tetra Pak, continue to innovate, focusing on sustainability and advanced packaging technologies to meet evolving market demands.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Consumer Goods

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release