ITS Logistics January Supply Chain Report: Recession Risks Heighten for US Economy as Consumer Confidence Decreases for Second Consecutive Month

ITS Logistics and DAT confirm key concerns in 2025 include the impact of inflationary pressures, high interest rates, tariffs, and global uncertainties

/EIN News/ -- RENO, Nev., Jan. 30, 2025 (GLOBE NEWSWIRE) -- ITS Logistics released the January ITS Supply Chain Report, revealing the U.S. economy was relatively stable last month but faced several headwinds. The job market remained strong, and inflation cooled significantly, but concerns about core inflation, higher interest rates, tariffs, and potential economic slowdown loomed. The Federal Reserve’s cautious approach to monetary policy and the housing market’s ongoing challenges also continued to influence the overall economic outlook.

“As the U.S. entered December 2024, the economic outlook carried both positive and negative trends that could influence the trajectory of the economy in 2025 and beyond,” said Stan Kolev, Chief Financial Officer of ITS Logistics. “While many indicators suggest resilience, a number of challenges pose significant risks to continued growth.”

Key concerns that supply chain professionals should be privy to include:

- Inflationary Pressure: If inflationary pressures persist or accelerate, it could erode consumer spending and confidence

- Monetary Policy Uncertainty: The risk of inflation becoming entrenched could lead to more aggressive action from the Federal Reserve, with possible interest rate hikes impacting consumer borrowing and business investment

- Global Economic Uncertainty: The global supply chain disruptions and rising geopolitical tensions could negatively impact US exports and supply chains, hurting sectors that rely on international trade

- Consumer Confidence: If inflation and high borrowing costs weigh too heavily on households, it could lead to reduced discretionary spending, further slowing growth in key sectors like retail, travel, and housing

-

Tariffs: Per the recent incoming Trump Administration announcement, there is a potential for an increase in tariffs. Companies should prepare for the potential of a front-loading event similar to 2018, disrupting transpacific trade lanes from Asia into North America

The Conference Board reported that this month alone, U.S. consumer confidence decreased for the second consecutive month. Its consumer confidence index declined to 104.1 from 109.5 in December. This is considered to be worse than the projections presented by economists, which were expected to result in a reading of 105.8. The index measures Americans’ assessment of current economic conditions and their outlook for the next six months. Overall, consumers’ outlook of current market conditions decreased by 9.7 points to a reading of 134.3 this month, while the views on current labor market conditions fell for the first time since September.

“In December 2024, the U.S. labor market remained strong but showed some signs of slowing as the year came to a close,” continued Kolev. “The U.S. economy added about 200,000 to 250,000 jobs last month, continuing a solid pace of hiring. While lower than the stronger job growth observed in 2021 and 2022, it still represented a healthy expansion, especially given the higher interest rate environment. The unemployment rate remained steady at 3.5%, continuing near historic lows. This suggested a tight labor market, with many employers still struggling to find workers.”

Although job growth slowed compared to earlier in the recovery, demand for workers remained robust, particularly in healthcare, hospitality, and blue-collar industries. However, concerns about higher interest rates and a potential economic slowdown in 2025 could bring more caution to the labor market.

While the U.S. economy was not yet in recession in December 2024, the risks are heightened as we move into 2025. The key concerns include how inflationary pressures, high interest rates, and global uncertainties will impact growth, consumer confidence, and business investment in the year ahead.

ITS Logistics offers a full suite of network transportation solutions across North America and distribution and fulfillment services to 95% of the U.S. population within two days. These services include drayage and intermodal in 22 coastal ports and 30 rail ramps, a full suite of asset and asset-lite transportation solutions, omnichannel distribution and fulfillment, LTL, and outbound small parcel.

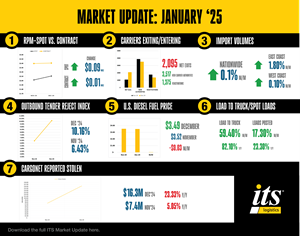

The monthly ITS Supply Chain Report serves to inform ITS employees, partners, and customers of marketplace changes and updates. The information in the report combines data provided through DAT and various industry sources with insights from the ITS team. Visit here for a comprehensive copy of the report with expected industry insights and market updates.

About ITS Logistics

ITS Logistics is one of North America's fastest-growing, asset-based modern 3PLs, providing solutions for the industry’s most complicated supply chain challenges. With a people-first culture committed to excellence, the company relentlessly strives to deliver unmatched value through best-in-class service, expertise, and innovation. The ITS Logistics portfolio features North America's #19 asset-lite freight brokerage, the #12 drayage and intermodal solution, a top 50 dedicated fleet, an innovative cloud-based technology ecosystem, and a nationwide distribution and fulfillment network.

Media Contact

Amber Good

LeadCoverage

amber@leadcoverage.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4910ceb2-75a8-407d-b57a-1342bbc2d3f0

Distribution channels: Science, Technology ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release