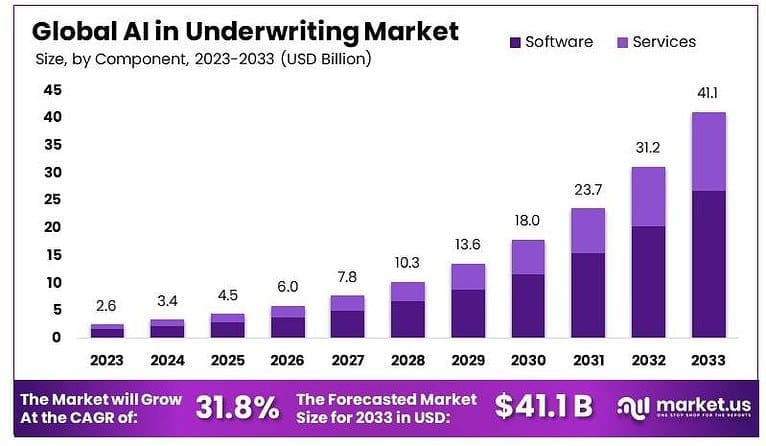

AI in Underwriting Market Boosts Writing Technology USD 41.1 Billion by 2033, CAGR at 31.8%

AI in Underwriting Market Size

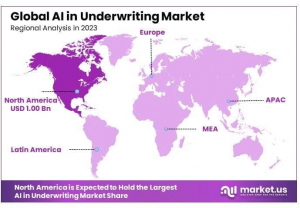

In 2023, North America led with 38.5% due to the region’s strong financial sector and technological advancements...

NEW YORK, NY, UNITED STATES, February 3, 2025 /EINPresswire.com/ -- The AI in Underwriting Market is projected to grow substantially, reaching an estimated valuation of USD 41.1 billion by 2033, up from USD 2.6 billion in 2023, driven by a strong CAGR of 31.8%. This market leverages artificial intelligence to enhance underwriting processes in insurance and financial services, improving efficiency, risk assessment, and decision-making capabilities.

As insurers and lenders increasingly adopt AI, they streamline operations, reduce time spent on mundane tasks, and focus on strategic activities, enhancing overall productivity.

AI's integration significantly impacts areas like fraud detection, where advanced algorithms analyze large datasets to identify fraudulent activities, potentially saving the industry billions in costs annually. Furthermore, AI adoption is supported by government initiatives and increasing regulatory requirements, especially in risk management and compliance.

🔴 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/ai-in-underwriting-market/request-sample/

The widespread acceptance of cloud-based solutions, offering scalability and cost-effectiveness, further fuels market growth. As insurers aim to maintain competitiveness in a rapidly evolving landscape, the role of AI in underwriting becomes essential for operational excellence and innovation.

These advancements underscore the transformative potential of AI, driving substantial interest and investment in this burgeoning market, and ultimately facilitating sophisticated, data-driven underwriting practices.

Key Takeaways

The market expected to grow from USD 2.6 billion in 2023 to USD 41.1 billion by 2033 at a 31.8% CAGR.

AI adoption improves efficiency, risk management, and customer satisfaction in underwriting.

Fraud detection and prevention are critical focus areas, potentially saving billions in costs.

Cloud-based solutions dominate due to their scalability and integration capabilities.

Machine learning leads technology adoption, enhancing predictive analytics and decision-making.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=126165

Experts Review

Experts emphasize that AI is revolutionizing underwriting by optimizing processes and enhancing risk assessments. With the integration of AI, underwriters can analyze complex datasets more effectively, reducing manual workload and improving decision quality.

This shift allows for more strategic focus, aligning with the growing trend of digital transformation across the financial sector. However, challenges such as data quality and high implementation costs remain significant barriers, particularly for smaller institutions. Experts caution that overcoming these obstacles requires strategic investment and an emphasis on developing robust data management practices.

Additionally, there is a growing need for transparency and explainability in AI outcomes to gain trust among stakeholders. Despite these challenges, the potential benefits of AI, such as cost reduction, fraud prevention, and improved compliance, position it as a crucial tool for enhancing underwriting practices. Companies that effectively harness AI's capabilities stand to gain a competitive advantage, fostering innovation and efficiency in the underwriting industry.

🔴 𝐓𝐨 𝐆𝐚𝐢𝐧 𝐠𝐫𝐞𝐚𝐭𝐞𝐫 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬, 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/ai-in-underwriting-market/request-sample/

Report Segmentation

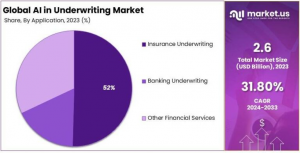

The AI in Underwriting Market is segmented by component into solutions and services. Solutions dominate the market, driven by the demand for advanced AI-powered platforms that streamline underwriting processes, from risk assessment to policy pricing.

Services, including consultancy and system integration, also hold a significant share as they facilitate the seamless adoption of AI technologies within existing systems, ensuring optimal performance and compliance. By deployment mode, the market is categorized into on-premises and cloud-based solutions, with cloud-based offerings gaining popularity due to their scalability, cost-efficiency, and easy integration capabilities.

Cloud solutions enable insurers to leverage AI technologies without the overhead of managing complex IT infrastructures, making them particularly attractive to medium and small-sized enterprises. Additionally, segmentation by application covers sectors like banking, financial services, insurance, and healthcare.

The insurance sector leads due to the immediate impact of AI on improving underwriting efficiencies, from personal insurance to commercial lines. In healthcare, AI applications in underwriting are gradually expanding, supporting tailored insurance offerings based on predictive analytics.

Geographically, North America holds the largest share of the market, propelled by technological innovation and a strong regulatory framework facilitating AI integration. These segmentation trends highlight the diverse applications and critical role of AI in transforming underwriting practices across industries.

Key Market Segments

By Component

Software

Services

By Deployment Mode

On-Premises

Cloud-Based

By Technology

Machine Learning

Natural Language Processing (NLP)

Robotic Process Automation (RPA)

Computer Vision

Other Technologies

By Application

Insurance Underwriting

Banking Underwriting

Other Financial Services

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=126165

Drivers, Restraints, Challenges, and Opportunities

Key drivers of AI in the Underwriting Market include the increasing demand for operational efficiency, enhanced risk assessment capabilities, and more personalized customer experiences. AI offers significant advantages in processing large data volumes swiftly and accurately, reducing underwriting cycle times and operational costs.

Additionally, regulatory compliance requirements and risk management are propelling AI adoption, as advanced analytics and machine learning offer more accurate predictive insights. However, the market faces challenges such as high initial implementation costs, data privacy concerns, and resistance to change from traditional underwriting practices.

Ensuring data quality and managing potential biases in AI algorithms are critical barriers that need addressing to fully leverage AI's potential. Despite these challenges, substantial opportunities exist, particularly with technological advancements in AI and machine learning, fostering innovation in predictive analytics and automated underwriting platforms.

The adoption of AI in emerging markets presents growth potential, offering scalable solutions to regions experiencing digital transformation. Companies that successfully navigate these challenges and harness AI technologies will be well-positioned to advance underwriting efficiencies, maintain competitiveness, and capitalize on new market opportunities.

Key Player Analysis

Key players in the AI in Underwriting Market include IBM Corporation, Microsoft Corporation, Oracle Corporation, and SAP SE. IBM leverages its strong AI capabilities, particularly in data analytics and cognitive computing, to offer robust underwriting solutions that optimize decision-making processes.

Microsoft focuses on integrating AI into its cloud-based platforms, enhancing real-time data processing and risk analysis for underwriting applications. Oracle's comprehensive solutions integrate AI-driven analytics to improve risk assessments and streamline underwriting workflows.

SAP SE provides powerful AI tools that facilitate predictive analytics and efficiency in underwriting operations. These companies are at the forefront of AI technology advancements, continually innovating to enhance underwriting efficiency and accuracy.

By investing in advanced AI capabilities and strategic partnerships, they maintain a competitive edge and set benchmarks for AI integration in underwriting practices. Their continued focus on developing scalable, flexible solutions ensures that they cater to diverse industry needs, positioning them as leaders in the rapidly growing AI in Underwriting Market.

Top Key Players in the Market

IBM Corporation

Microsoft Corporation

Google LLC (Alphabet Inc.)

Amazon Web Services, Inc. (AWS)

SAP SE

Salesforce, Inc.

Oracle Corporation

Capgemini SE

Infosys Limited

Tata Consultancy Services Limited (TCS)

Lemonade, Inc.

Shift Technology

Other Key Players

Recent Developments

Recent developments in the AI in Underwriting Market showcase significant advancements in AI capabilities and their applications in enhancing underwriting processes. In early 2024, IBM announced the integration of advanced machine learning algorithms into its underwriting platform, aimed at improving risk assessment accuracy and reducing processing times.

Microsoft launched a new AI-powered cloud service tailored for the insurance industry, enhancing predictive analytics and real-time data insights for underwriters. Oracle has expanded its suite of AI-driven tools to include innovative features that streamline policy pricing and customer engagement through enhanced data analytics.

SAP SE introduced a new version of its AI platform, emphasizing automated risk analysis and compliance management, catering to the evolving regulatory landscape. These developments highlight the industry's commitment to utilizing cutting-edge AI technologies to transform underwriting practices, offering companies the tools needed to improve efficiencies, reduce costs, and enhance the customer experience. As AI continues to evolve, its integration into underwriting processes will significantly shape the future of the industry.

Conclusion

The AI in Underwriting Market is poised for substantial growth, driven by the increasing demand for efficiency, accuracy, and personalization in underwriting processes. Despite challenges such as implementation costs and data privacy concerns, the integration of AI and machine learning offers transformative benefits, including enhanced risk assessments and reduced operational costs.

Innovative leaders in the industry are harnessing AI's full potential, setting new benchmarks for underwriting excellence. As businesses strive to maintain competitiveness in a dynamic market, the adoption of advanced AI solutions will play a crucial role in shaping the future of underwriting and driving sustainable growth and innovation.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Ultra-High-Speed Wi-Fi Market - https://market.us/report/ultra-high-speed-wifi-market/

Workforce Management Market - https://market.us/report/workforce-management-software-market/

Voice Search Market - https://market.us/report/voice-search-market/

LiDAR Market - https://market.us/report/lidar-market/

Drone Software Market - https://market.us/report/drone-software-market/

Quantum Computing-as-a-Service (QCaaS) Market - https://market.us/report/quantum-computing-as-a-service-qcaas-market/

Generative AI In Utilities Market - https://market.us/report/generative-ai-in-utilities-market/

Generative AI in Banking Market - https://market.us/report/generative-ai-in-banking-market/

Security Safes Market - https://market.us/report/security-safes-market/

Spintronics Market - https://market.us/report/spintronics-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release