Key advantages of investing in Bajaj Finserv Consumption Fund

/EIN News/ -- PUNE, India, March 17, 2025 (GLOBE NEWSWIRE) -- India’s evolving consumption landscape offers opportunity to investors, thanks to a growing middle class and shifting consumer habits. The Bajaj Finserv Consumption Fund stands as a gateway for those looking to capitalize on this surge. By strategically investing in key sectors poised for growth, this fund targets long-term potential gains driven by rising domestic consumption.

India’s consumption wave

The consumption boom in India is powered by a union of socio-economic changes. As more people enter the middle class with increased purchasing power, the demand for a diverse range of goods and services is expected to grow. This transformation is shaped by several trends:

Rising affluence: India is seeing a shift toward more affluent consumers, who are now prioritizing quality over quantity in their purchasing decisions. The demand for luxury and premium products is rapidly increasing, with people seeking value-added goods that improve their lifestyles.

Health and wellness: A growing focus on well-being has led to a rise in demand for health-centric products. Consumers are now more conscious about what they consume, choosing items that align with a health-conscious lifestyle, such as organic food, fitness-related products, and immunity-boosting supplements.

Convenience: Convenience-driven purchasing has skyrocketed, with online shopping, food delivery, and quick-service solutions gaining traction. Today’s consumers want easy and fast access to products, shifting the retail sector toward e-commerce and other digital platforms.

Broadening consumption horizons: India’s rural markets are registering growing demand and provide an opportunity for driving the consumption sector.

How the Bajaj Finserv Consumption Fund taps into these trends

The Bajaj Finserv Consumption Fund seeks to leverage these trends by investing in companies directly benefiting from India’s growing consumption sector. Here’s how it aligns with the evolving market:

Investing in high-growth sectors: The fund targets businesses that are positioned to capitalize on the changing consumer behaviour. By investing in emerging sectors, it taps into the rapid growth driven by rising disposable incomes and evolving consumer preferences.

Focused approach: Staying true to its theme, the fund focuses on sectors and companies directly impacted by increased consumption. This detailed and defined strategy ensures that every investment decision aligns with the broader goal of capturing growth in the consumption space.

Diverse market exposure: Unlike traditional funds that focus solely on large cap stocks, the Bajaj Finserv Consumption Fund adopts a more flexible approach. It invests across the market cap spectrum, balancing the stability of established firms with the growth potential of mid and small cap companies.

Future-oriented investment philosophy: The fund focuses on long-term growth by identifying emerging trends and high-potential companies. This proactive approach ensures that the fund remains ahead of the curve and positions itself to benefit from the next wave of consumption-driven growth.

Who should consider this fund?

The Bajaj Finserv Consumption Fund may be well-suited for a wide range of investors. Whether you are looking for high-growth potential or diversification in your existing portfolio, this fund offers several advantages:

Lumpsum investors: For those looking to make a one-time investment, the fund presents a unique opportunity to tap into India’s expanding consumption market.

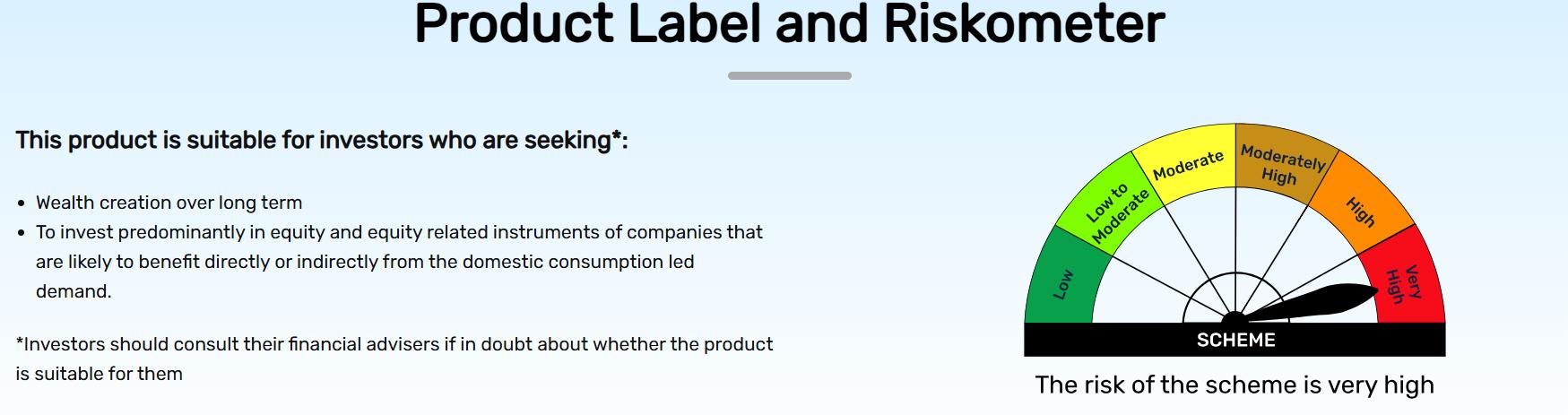

Risk-tolerant investors: If you are open to higher risks in pursuit of returns, this fund aligns well with your objectives. The consumption sector has the potential for both high growth and volatility, making it suitable for those with a higher risk tolerance.

Tactical portfolio diversification: If you want to add depth and variety to your equity portfolio, this fund can be a way to diversify into a specific sector that shows tremendous growth potential. It complements broader investment strategies and enhances overall portfolio performance.

Long-term investors: The fund is a suitable option for those with a five-year or more investment horizon. By focusing on long-term growth, the fund allows investors to ride out market fluctuations while benefiting from the overall rise in consumption.

Enhancing your investment strategy

To optimize the potential of your investment, consider using tools like a monthly SIP calculator. This tool allows you to systematically invest small amounts over time, leveraging the power of compounding and making it easier to achieve your investment goals in the long run.

The Bajaj Finserv Consumption Fund offers opportunity to invest in India’s dynamic consumption sector. With its focused investment strategy and forward-looking approach, it may benefit from the projected growth in domestic consumer demand. Whether you are a seasoned investor or just getting started, this fund provides the tools and strategy necessary to tap into the evolving consumption trends and build wealth for the future.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. This information is subject to change without any prior notice.

Bajaj Finserv Consumption Fund is an open ended equity scheme following consumption theme.

Contact Info:

Phone no.: 1800-3093900

Name: Gaurav Parmar

Email: gaurav.parmar@bajajamc.com

Organization: Bajaj Finserv Asset Management

Disclaimer: This press release is provided by the Bajaj Finserv Asset Management. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing involves significant risks, including the potential loss of capital. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b95feccc-47af-4ee5-bb65-42b2ef1a7e0b

Distribution channels: Banking, Finance & Investment Industry, Media, Advertising & PR ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release