Bexar Appraisal District Budget, Parcels, ARB

O'Connor conducted a comprehensive analysis of the budget, parcels, and Appraisal Review Board (ARB) in Bexar County.

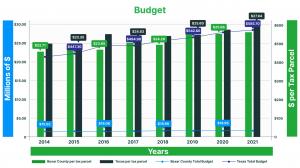

AUSTIN, TEXAS , UNITED STATES , March 29, 2024 /EINPresswire.com/ -- In the tax year of 2021, Bexar County’s appraisal district allocated a budget of $18.8 million, while the appraisal review board’s portion of the budget was around $750,000. With around 700,000 tax parcels within the district, this equates to an expenditure of roughly $26.20 per parcel. Notably, this figure is short of the 2021 statewide average of $27.29 by 3.9%. Overall, Texas’ total appraisal budgets amounted to $585 million for the year.

Appraisal District Budgets

The Bexar Appraisal District had a budget of $18,840,000, which was lower than the highest statewide budget held by Harris Central Appraisal District at $93,000,000. Following Harris Central Appraisal District, Tarrant Appraisal District had a budget of $25,500,000, Collin Central Appraisal District trailed with $23,500,00, and the Travis Central Appraisal District budget totaled $20,200,000.

The Bexar Appraisal District’s budget increased by 27.6% from 2011 to 2021. The BAD budget was $14.76 million in 2011 and rose to $18.84 million in 2021.

During the fiscal tax year 2021, the Tarrant County Appraisal Review Board secured the second-highest budget among all counties, totaling $1.4 million. Leading the rankings was the Harris County ARB with a budget of $3,250,000. Following Tarrant County were the Travis County ARB at $1,201,000, Fort Bend County ARB at $1,090,000, and Dallas County ARB at $1,074,000.

Over the years, the staff at Bexar Appraisal District has seen a gradual increase, from 157 employees in 2011 to 161 in 2021. The number of appraisers in the district grew to 77 in 2021, up from 76 in 2011. Despite this growth, Bexar Appraisal District maintains a modest staff size compared to statewide appraisal district statistics.

Tax Parcels per Employee – Bexar Appraisal District versus Texas

In 2021, the Bexar Appraisal District averaged 2,485 tax parcels per employee, whereas the statewide average is 4,413 tax parcels per appraiser.

Tax Parcels per Appraiser – BAD versus Texas

Bexar Appraisal District employed 1 appraiser for every 15,735 accounts versus 8,435 statewide.

Bexar Appraisal District appraiser allocation follows:

In the Bexar Appraisal District, there are 46 appraisers focused on residential properties, 17 appraisers handling commercial properties, and 14 appraisers responsible for all other property types. The total Full-Time Employees (FTE) appraiser count is 77.

Appraisal District Employee Allocation – BAD versus Texas

Statewide appraisal districts allocated their appraisers as follows:

Across the Statewide Appraisal District, the 2,485 appraisers fulfill various roles: 1,264 (51%) specialize in residential appraisals, 568 (23%) in commercial appraisals and 653 (26%) in various other types of appraisals. Together, they comprise 100% of the total Full-Time Employees (FTE) dedicated to appraisals.

Appraiser versus Administrative Staff at Bexar Appraisal District

According to a statewide comparison of data gathered by the Texas Comptroller, the Bexar Appraisal District employs more administrative/operations staff than appraisers. BAD staff is split into 55% appraiser and 44% administrative. The statewide staff allocation in assessment districts is 52% appraisers and 48% administrative.

Appraisal District Appraiser Allocation

Compared to other districts in Texas, Bexar County allocates a larger percentage of its appraisal resources to residential properties. Statewide, 51% of appraisers focus on residential properties, while in Bexar County, this figure stands at 60%. Conversely, 23% of appraisers statewide specialize in commercial appraisals, slightly lower than Bexar County’s 22%. Bexar County dedicates 18% of its appraisers to industrial and commercial personal property, in line with statewide trends.

Revaluation Cycle

Bexar County consistently reassessed every parcel annually from 2014 to 2021, while statewide appraisal districts only revalued about 80 to 90% of parcels during this timeframe. This frequent reassessment schedule sets Texas apart from most states, where property revaluations typically occur every 3 to 6 years.

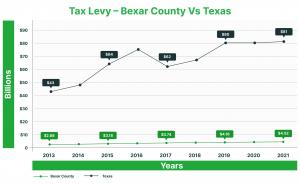

Tax Levy – Bexar County versus Texas

The Bexar County property tax levy witnessed a remarkable surge, climbing from $2.6 billion in 2013 to $4.5 billion in 2021, marking a substantial 68% increase. Notably, per capita property tax rates outpaced population growth, prompting the introduction of Senate Bill 2. This legislation imposes a cap on levy growth, limiting it to 3.5% for cities and counties, which includes new construction, and 2.5% for schools, encompassing new construction as well.

Texas Levy Growth

During the period spanning 2013 to 2021, the statewide tax levy in Texas surged by 69%, reflecting an annual growth rate of 8.6%. This substantial increase surpassed the combined impacts of population growth and inflation, leading to an 88% rise in the per capita tax burden over the same timeframe.

Bexar County versus Texas Per Capita Property Tax Growth

Between 2013 and 2021, Bexar County saw a 49% increase in per capita property taxes, whereas Texas experienced a higher growth rate of 88%. Per capita property tax in Bexar County rose from $1,488 in 2013 to $2,216 in 2021. Despite starting at a lower level, the Bexar County per capita tax levy rapidly caught up with statewide figures. By 2021, the statewide property tax levy per person reached $2,740, slightly surpassing the $2,216 observed in Bexar County.

ARB Staffing – Bexar County versus Texas

In comparison to the statewide average, Bexar County boasts a higher number of staff members dedicated to the Appraisal Review Board (ARB). Bexar Appraisal Review Board members assessed 14,878 tax properties, surpassing the statewide figure of 11,498. This staffing allocation aligns with the significant utilization of the Appraisal Review Board in Bexar County.

COVID Impact on Appraisal Review Board Staffing

Typically, counties rely heavily on seniors to staff the appraisal review board. Because age is a risk factor for many diseases, including COVID, this resulted in many appraisal districts experiencing serious consequences for their staffing . From 2019 until approximately October 2023, the Bexar Appraisal Review Board has maintained a consistent roster of 50 members, avoiding a more critical decrease in workforce.

ARB Days of Hearings

Appraisal Review Boards in counties across Texas compensate members to hear tax protests not resolved in informal hearings. These boards convene 5 to 6 days a week for several months. In 2021, Harris County and Hays County led with 158 days of ARB hearings. Comal followed with 100 days, then El Paso with 97 days, Tarrant with 90 days, and so forth, down to Galveston with 73 days.

Why More ARB Hearings in Some Counties

The Appraisal Review Board (ARB) marks the second phase in a three-step process. The initial two phases, informal hearings, and ARB hearings, collectively termed “administrative hearings,” precede it. Following these, property owners can opt for 1) binding arbitration, 2) court appeal, 3) State Office of Administrative Hearings (SOAH) or take no action. After the ARB, approximately 98% of owners opt for no action.

Practice Tip: It’s advisable to pursue further action after the appraisal review board on an annual basis.

Appraisal districts usually face tax protests for approximately 10 to 25% of tax parcels, constituting 38% of statewide value. In Bexar County, property owners file tax protests for around 24% of tax parcels, representing 58% of the total value. Typically, more valuable properties are subject to protest, including commercial, industrial, and business personal properties, which see protests almost every year.

Owners Who Don’t Protest

Entry-level and mid-range homeowners are often underrepresented in property tax appeals, mainly due to various reasons. Conversely, major business owners consistently engage in yearly protests, signaling their belief that regular property tax appeals are crucial for controlling property taxes. However, many major business owners only pursue half of the necessary steps, typically focusing solely on the administrative process.

Owners of Commercial Valued over $750,000

For most commercial property owners, it’s advisable to proceed with their appeals following the administrative hearings (informal and appraisal review board). According to assessment district statistics from the Texas Comptroller, there’s a 90% chance of achieving an additional 10% reduction. It’s important to note that these findings pertain to statewide aggregate judicial appeals and not accounting payable claims.

Who is Watching Your Interests?

Bexar Appraisal District, with a budget exceeding $18.8 million with $750K specifically funding the ARB, manages the assessment of Bexar County’s 0.72 million tax parcels. Employing 161 individuals, including 77 appraisers, the district aims for accurate and consistent property appraisal. Yet, if assessments surpass market value, property owners may face inflated tax burdens.

Can You Afford an Ally to Look Out for Your Interests?

Why Does Bexar Appraisal District (BAD) Overvalue Properties?

BAD annually assesses nearly three-quarters of a million tax properties using mass appraisal techniques, which involve aerial photography inspections every three years. However, aerial photography alone may lack detailed information. The district relies on mass appraisal models and incomplete property data, resulting in some properties being assessed below 100%, subject to challenges for unfair valuation, while others are valued above 100% of their market worth.

Are You Undervalued or Overvalued?

To determine if your property is over or under-valued, you should follow these steps:

File a protest annually before the May 15th deadline.

Request the appraisal district’s hearing evidence, which also freezes the material they may use at the hearing. Prepare for and attend the informal hearing, where approximately 70 to 90% of cases are resolved with a reduction.

Proceed to the appraisal review board and, if needed, take further action.

Practice tip: Note that an informal appraisal review board hearing cannot be used to increase your property tax assessment.

What does BAD Valuation at 100% Mean?

When the Bexar Appraisal District assesses a property with a median level of assessment of 100% relative to market value, it indicates that:

Half of all properties have a market value greater than the assessed value. This relationship is typically depicted as a bell curve on a graph showing the

correlation between the BAD (Bexar Appraisal District) value and market value. Some properties are slightly undervalued, while others are assessed at double or more the market value.

Even though 50% of properties are assessed below market value, they can still be challenged for market value and unequal assessment. When filing your objection, ask the appraisal district to provide you with the hearing evidence packet. Typically, the BAD (Bexar Appraisal District) similar sales data will contain several relevant comparable sales. If not, you can research your street and neighborhood for comparable assessments that support a reduction.

You have the option to protest based on market value (if your property’s actual market worth has been overestimated) or unequal appraisal. The premise is that a sufficient number of properly adjusted similar properties indicate a lower value. Regardless of the grounds for objection, a reduced tax assessment leads to lower property taxes.

What if You Don’t Have Time or the Temperament to Protest?

Hire us or consider a competitor. Research shows that frequent protesters often enjoy lower property taxes. Additionally, reductions in one year can significantly impact negotiations for subsequent years by lowering the base value.

Benefits with O’Connor:

There are no fixed fees, no upfront costs, and no filing expenses EVER. We simply deduct a percentage from your savings.

Sign up online in just 3 minutes, no fees, and no credit card needed. Alternatively, give us a call if you prefer.

At O’Connor, you’ll connect with a live person every time. Trained property tax specialists handle 99% of incoming calls. From October 2 to 6, our customer support team received 1210 calls, with only 10 left unanswered.

O’Connor leads tax appeals across Texas, engaging in disputes in approximately 180 counties. We pride ourselves on our proactive approach, frequently utilizing binding arbitration, initiating court appeals, and leveraging the State Office of Administrative Appeals.

O’Connor is dedicated to enhancing property owners’ lives through efficient tax reductions. Through the creation of cost segregation reports to enhance property owners’ depreciation (non-cash expenditure), we saved property owners $1224 million in property taxes and $400 million in federal income taxes in 2023 alone.

Get started now with O’Connor and lower your property taxes! With no upfront costs or fixed prices, you only pay a percentage of the savings when we successfully reduce your property taxes.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, and commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost-effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.